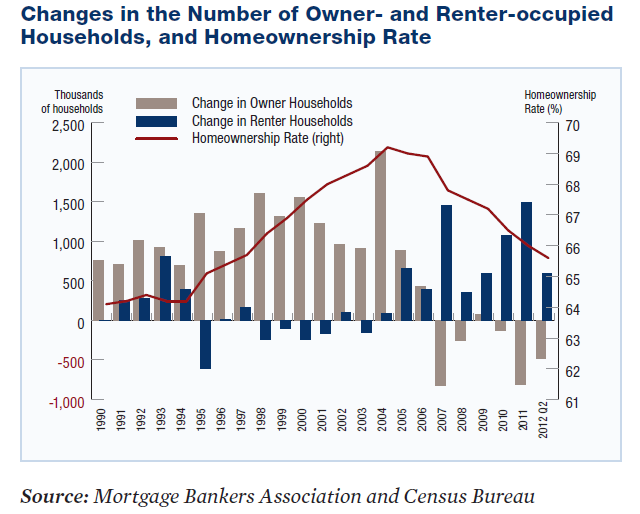

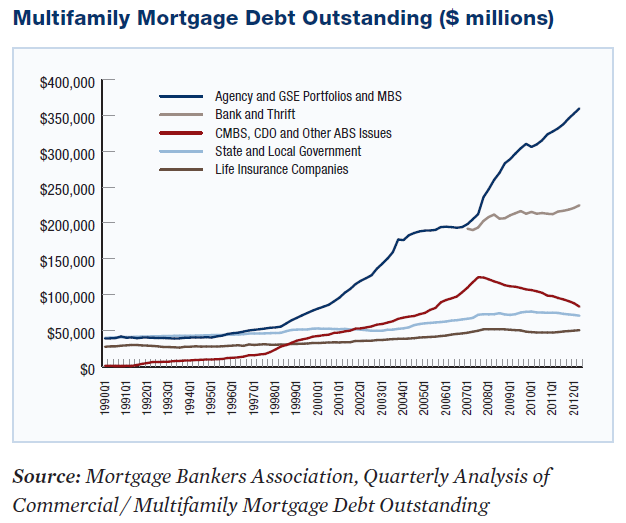

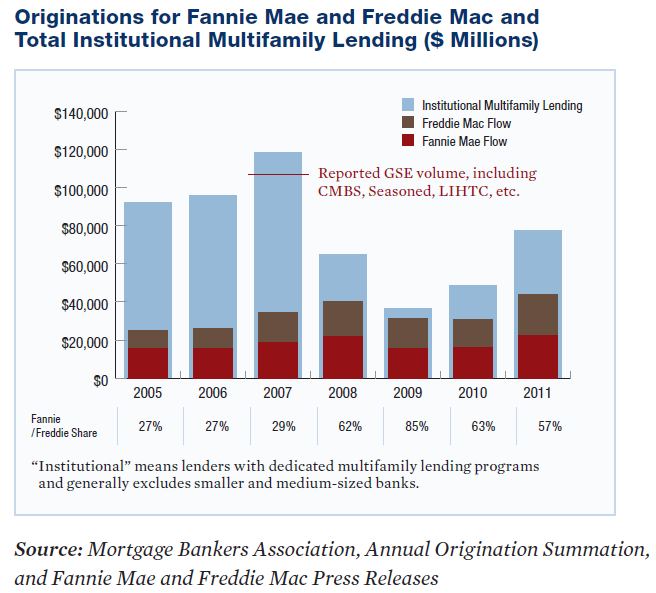

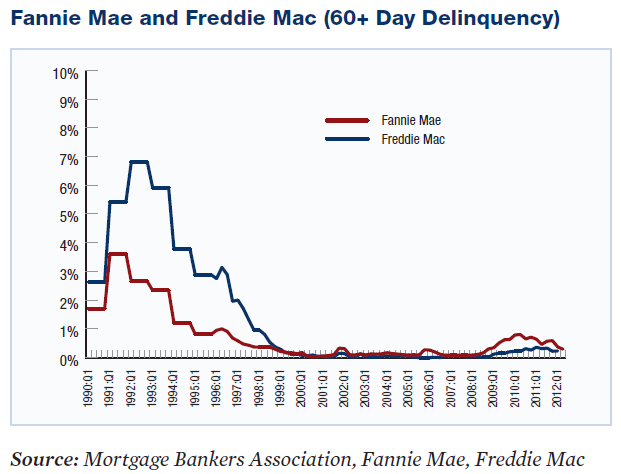

The Mortgage Bankers Association is out today with a white paper “Ensuring Liquidity And Stability: The Future Of Multifamily Housing Finance And The Government-Sponsored Enterprises“. (or see the MHN exec sum here) The paper highlights the role of the GSEs (Government Sponsored Enterprises, i.e. FNMA ‘Fannie Mae’ and FHLMC ‘Freddie Mac’) in today’s multifamily finance market and presents five recommendations for the future making their points with a set of charts that demonstrate the size of their role in multifamily as well as the very low amount of bad loans they’ve made in the sector.

- Our nation’s housing policies should reflect the importance of multifamily rental housing, the range of capital sources that support this market, and the need for liquidity and stability in all market cycles.

- Private capital should be the primary source of financing for multifamily housing with a limited, government-backed insurance program ensuring that the market has access to liquidity in all cycles. The FDIC-like risk insurance program would provide support at the mortgage-backed security, rather than at the entity, level.

- Entities eligible to issue government-backed securities should be mono-line, funded by private capital, focused on securitization, serve the workforce rental market, and regulated in a manner that protects taxpayers and ensures robust competition among capital sources.

- Stewardship of existing GSE assets and resources on behalf of taxpayers should be a core consideration for any policymaker action — during the current period of conservatorship, any transition period, and in the future state of multifamily finance.

- The long-term liquidity and stability of the multifamily finance system in all market cycles, rather than whether the existing multifamily business lines could survive as ongoing businesses, should be the core driver of whether the GSEs’ multifamily businesses should operate on a standalone basis.

Hopefully the cooler heads in Congress and the administration will prevail and the stability GSEs provide to multifamily finance, especially during market downturns and disruptions will continue. To find out about how you can take advantage of the good terms and rates available through Fannie, Freddie and HUD for apartment building investments send a message to us through our Contact Us page.