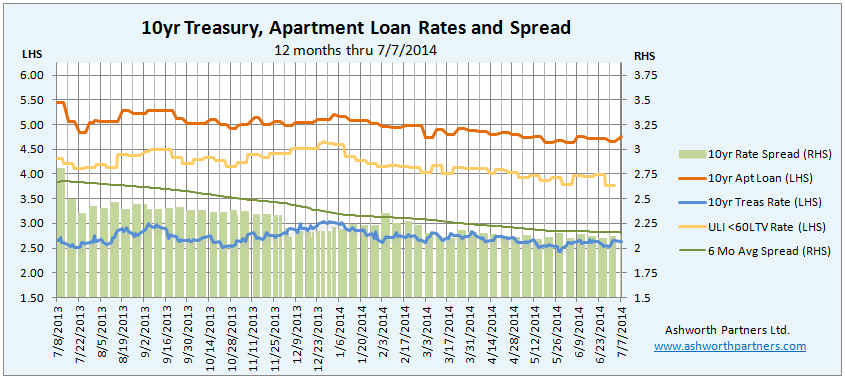

The apartment building loan rate we track came in today at 4.765% (see below for loan details), making it 22 straight weeks below the five percent mark. The spread to the 10 year Treasury (T10) also remained in the 2.1 and change range where it’s been since the beginning of March, indicating that the very competitive market for multifamily loans continues on.

For the gold plated ULI less than 60% LTV loan the spread dropped into the 1.2s from the 1.3 range where it had been holding since late February, taking the implied rate for these core institutional apartment loans down to 3.77%.

Speaking of the spread between the T10 and the apartment building rate we track, the green line on the chart represents the six months trailing average spread. We track changes in the trend for signs apartment lenders becoming more or less competitive. Note that since rates are only quoted on business days the chart averages the last 120 business days which equates to roughly six months.

We track the 10 year Treasury because that is the benchmark most lenders base their long term rates on. In order to lure investors away from Treasuries to buy mortgage bonds lenders have to offer a premium (AKA ‘spread’) over what can be earned on the Treasury. So when the T10 moves, rates on all kinds of longer term loans including on apartments tend to move also. As you can see in the chart, the spread also widens and narrows as market forces make an impact.

Notes about the apartment loan rates shown in the chart above: The rates shown here are from one West Coast regional lender for loans on existing apartment buildings between $2.5 – 5.0M. The rate quote they send every Monday that I track is a 30 year amortizing loan with a fixed rate for 10 years (They also have other fixed periods at different rates). The max LTV for this loan is 75% (they have an even lower rate on their max 60LTV loans) and the minimum Debt Cover Ratio (DCR, aka DSR or DSCR) is 120. Note too that these are ‘sticker’ rates, LTVs and DCRs and ‘your millage may vary’ depending on how their underwriting develops. I usually figure that we’ll end up at a 70LTV which also helps the debt cover and provides a larger margin of safety, which is half the battle from a value investing standpoint.

The prepay fee is 5,4,3,2,1% for early repayment in the first five years and you do have the ability to get a 90 day rate lock. The minimum loan is $500k (at a slightly higher rate for less than $1M loans) and they’re pretty good to work with as long as you go in knowing that it takes up to 60 days to close their loan. If you are looking at acquiring an apartment building in California, Oregon or Washington I’d be happy to recommend you to my guy there for a quote. Send me a message through this link and I’ll make an introduction for you.

The other rate we track is the from the Trepp survey which the ULI (Urban Land Institute) reports on. According to the ULI the Trepp rate is what large institutional borrowers could expect to pay on a 10 year fixed rate, less than 60% LTV loan for a “crème de la crème” core property located in a gateway market. We track this rate as a barometer of what the largest lenders are offering their best customers on the most secure loans for any advanced warning about future rate and spread changes. Note that the spread we chart is between 10yr loan we track and the T10.

How the St. Louis Fed calculates the 10 year Treasury rate displayed above: “Treasury Yield Curve Rates. These rates are commonly referred to as “Constant Maturity Treasury” rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of quotations obtained by the Federal Reserve Bank of New York. The yield values are read from the yield curve at fixed maturities, currently 1, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity. For even more detail see: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/yieldmethod.aspx

As a reminder, one basis point or 1bp is equal to one-one hundredth of one percent or .0001. When you hear ‘fifty basis points’ that’s one-half of one percent; ‘125bp’ would be 1.25% or a percent and a quarter, sometimes referred to as ‘a point and a quarter’. A bp seems like a tiny number, too fine to make a difference but in the debt world if you can squeak out an extra 20bp on a 100 million dollar deal (like a pool of apartment building loans) that’s $2oo,000.00 in your pocket. To paraphrase Everett Dirksen: “20bp here, 20bp there and pretty soon you’re talking about real money.”

Do You think that a person just starting out in the investment should invest in apartments?

Great question Moe. Because apartment building investing is such a numbers game, success in multifamily as a first time real estate investor would hinge particularly on understanding financial statements and how they effect valuation. If an individual has experience analyzing company P&Ls, balance sheets and earnings statements they would have a head start in learning how apartment investment deals work. I think value investors have a particular advantage in this regard.

Another issue is financial depth. Multifamily properties (5+ units) require larger amounts to purchase and operate and for long term success having sufficient reserves to cover emergencies and periodic capital expenses as well as updating the property to keep it competitive is critical. Apartment building investments are not something that should be done on a shoestring. Not saying it can’t be done but the surprises come with a bigger price tag with a larger property.

If an investor is confident in their analytical skills and has the financial depth to stay in the game long term I believe apartment buildings are a very good first commercial property investment. A number of our clients fit this category and by taking advantage of our expertise and network of professionals have made successful multifamily investments. Other clients understand the value proposition but lack the time availability and/or the level of confidence they require and have found being part of a group investment run by seasoned operators is the best way to make their first apartment deal.

Either way successful apartment building investing is a team sport and with an experienced squad of professionals on your side I believe that starting with multifamily is a good way to begin.