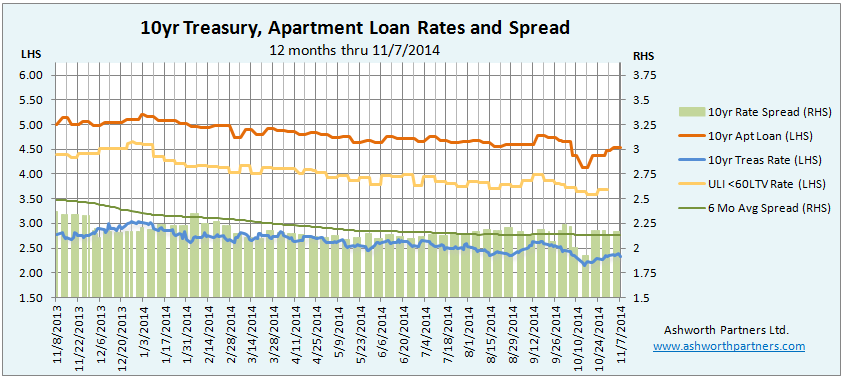

What a month it was for apartment building investment loan rates. The week we were all wondering How is Columbus Day Still a Thing? The 10yr rate we track fell to a low of 4.139% with the spread between it and the 10yr Treasury (T10) breaking below 2% to 1.929 (See below for details on both). I have to hand it to the ULI, they’re good. They had just said:

“If you are waiting for someone to ring a bell and say that we have reached the bottom, consider the bell rung. Think twice about ignoring these record-low levels.”

It only lasted a week but the rate stayed below 4.5% through the end of the month:

As you can see, that one week the spread was also well below its six month average while the T10 got as low as 2.15%, territory it hadn’t seen since the middle of June 2013. We finally got some updated numbers on the ULI rate which would have been nice to have in real time as it was stepping down consistently for six weeks starting in the middle of September, foreshadowing the Continue reading The Great Columbus Day Apartment Loan Rate Massacre and other interesting interest rate stories