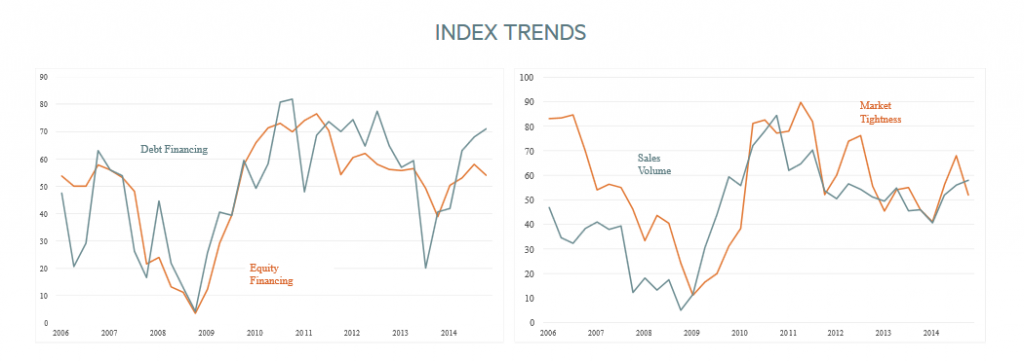

The National Multihousing Council’s (NMHC) latest apartment investment survey out today has market tightness falling to 52 from 68 last quarter. With 50 representing the better vs. worse divide, results show respondents are feeling the bite of new supply plus a bit of seasonal slowdown as well I sense:

While the Sales Volume and Debt Financing measures both improved, Equity Financing also slipped. As you can see from the charts above the results tend to be noisy and I suspect that with the survey format it carries a few behavioral biases as well. You can see that the world was ending according to Continue reading Apartment Market Tightness, Equtiy Financing Slide Backwards in Latest NMHC Survey