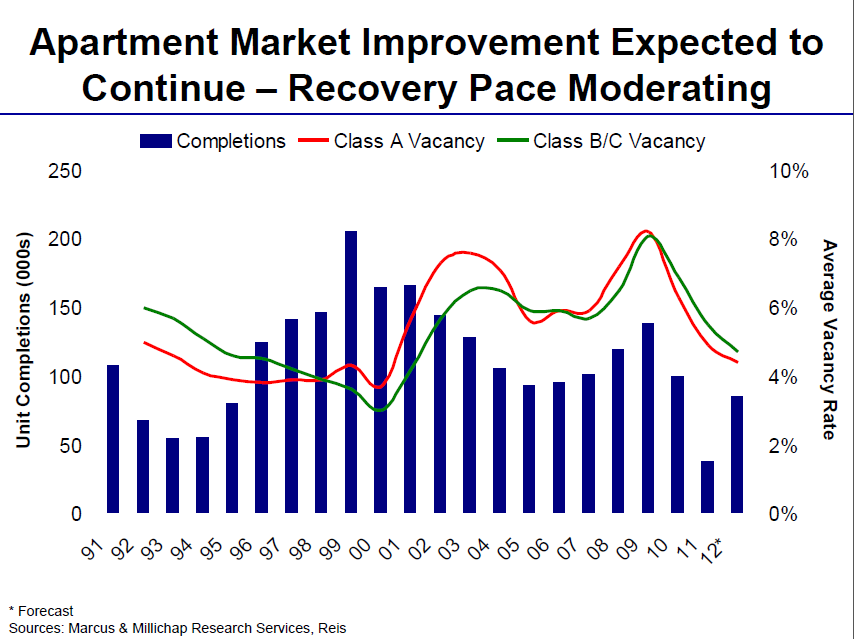

Good presentation on the current national apartment building investment sector from Marcus & Millichap. New supply remains constricted except for a few cities, they didn’t mention any names *cough Seattle cough* but if you’re in one of them and tracking the pipeline it’s easy to read between the lines.

Another interesting trend is that nobody is building class B apartments, it’s nearly all A+ ‘marquee’ properties. I believe that this creates an opportunity to provide good housing for the large majority of working class, young professionals and empty nesters by acquiring existing class B.

Another trend is that institutional investors are discovering markets outside the coastal gateway cities venturing into secondary markets and even tertiary. What I’ve seen is that institutional activity tends to depress cap rates but not just in institutional grade properties. Owners of smaller and/or lower class properties believe their properties are worth more because ‘the big guys are getting more’ which in their minds means all are worth more. Not mentioning Seattle but in working on several $#1-2 million deals for individual investor clients most of the properties we’ve seen don’t even cash flow positively at anywhere near the asking price.

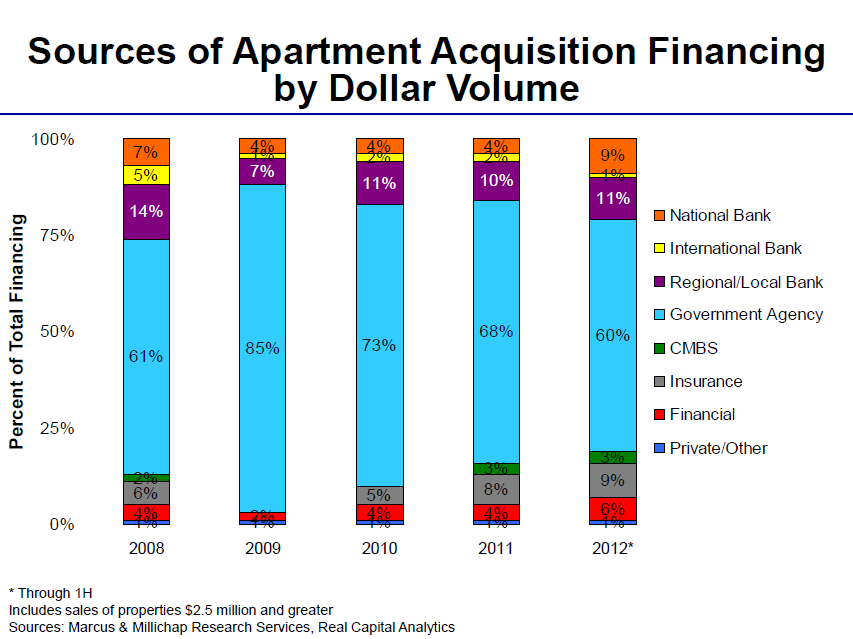

In the capital markets most of the financing is still through the GSEs, Fannie, Freddie and HUD although national banks have more than doubled their slice while regional/local banks have taken a bit of business from the internationals. CMBS is holding in at about three percent of volume, up from zero in 2010 and insurance and other financial companies are slowly growing their share.

On the West Coast at least Chase has been very aggressive even on small properties. We’re working on several deals in the $1-2 million range right now and they have the best rates and terms we’ve been able to find… but we’re still searching. One of our client’s investment plan calls for 25 or 30 year fixed rates and while everyone seems to be offering 25 or 30 year terms, we haven’t found any offers longer than a 10 year rate lock. If you are a provider or know a source of longer term financing for this size property in the Pacific Northwest region we would really like to hear from you. Click here to contact us.

One other positive trend in the lending arena is that (unless you are a developer) development financing is fairly tight and getting tighter. As owners and acquirers that provides additional confidence and in a larger sense shows hope that market participants still remember the lessons learned (re-learned) from five years ago.

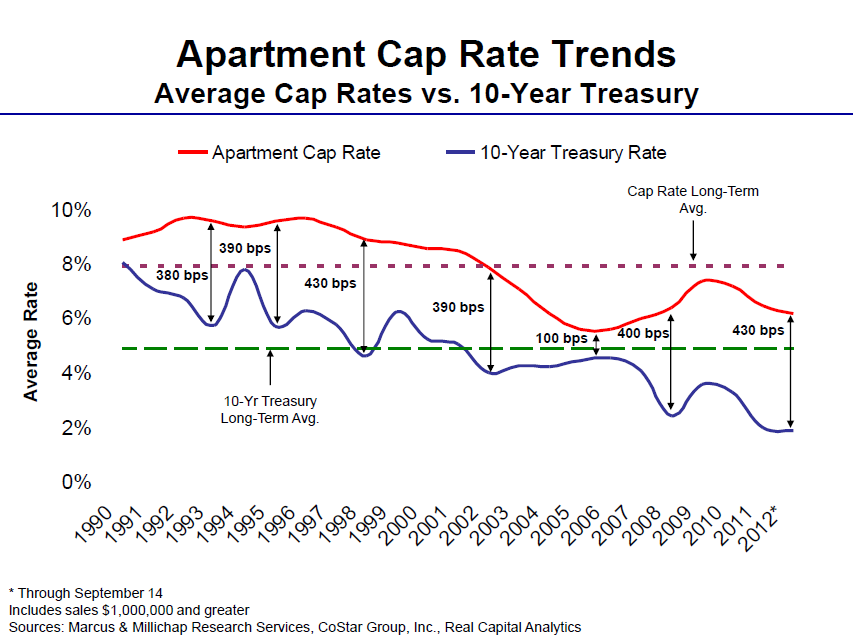

One the investment climate nationally they showed a chart tracking the spread between average apartment cap rates and 10 year Treasuries where the spread is at near record levels. Personally with (real, financeable) cap rates in the five to six range that doesn’t excite me but they had a very good point: Every time the spread has been large like this has been a very good time to make apartment building investments.