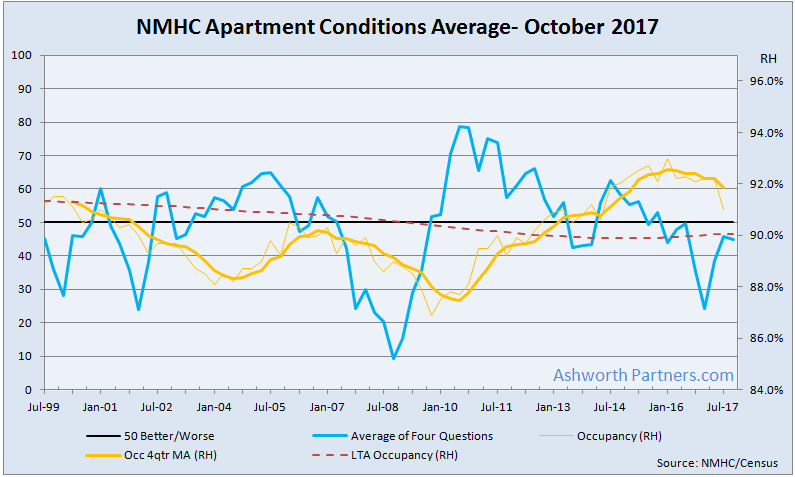

The National Multi Housing Council’s Apartment Conditions average has not been above the 50/50 better/worse level since Q2 2015, coming in at 45 in the latest report. The only index component to register above 50 was Debt Financing which came in at 51, up 4 points since last quarter.

Market Tightness remained below 50 for the eighth straight quarter, falling 6 points to 37. Sales Volume eased slightly from 47 to 45 and Equity Financing held steady at 46, also in negative territory for the last two years.

In its commentary the NMHC noted that respondents reported rising occupancy in areas affected by the recent hurricanes and fires but in other markets the volume of new unit deliveries is causing concessions to appear. Note: Census has not yet reported 3rd quarter occupancy.

According to the NMHC: The reported index numbers are based on data compiled from quarterly surveys of NMHC members. Survey responses reflect the change, if any, from the previous quarter. The indexes are standard diffusion indexes, hence are convenient summary measures showing the prevailing direction and scope of changes. They are calculated by taking one-half the difference between positive (tighter markets, higher sales volume, equity financing more available, a better time to borrow) and negative (looser markets, lower sales volume, equity financing less available, a worse time to borrow) responses and adding 50. This produces a series bounded by 0 (if all respondents answered in the negative) and 100 (if all respondents answered in the positive).

1 A Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged.

2 A Sales Volume Index reading above 50 indicates that, on balance, sales volume and the country is increasing; a reading below 50 indicates that sales volume is decreasing; and a reading of 50 indicates that market conditions are unchanged.

3 An Equity Financing Index reading above 50 indicates that, on balance, equity finance is more available; a reading below 50 indicates that equity finance is less available; and a reading of 50 indicates that equity finance availability is unchanged.

4 A Debt Financing Index reading above 50 indicates that, on balance, borrowing conditions are improving; below 50 indicates that borrowing conditions are worsening; a reading of 50 indicates borrowing conditions are unchanged.