As every landlord knows, operating expenses (OPEX) are an important element of commercial real estate investment performance. In spite of the important role OPEX plays in investment performance, there is very little research that analyzes the structure of these costs or identifies what drives the differences in these costs across markets. This article aims to share the latest findings on the drivers and structure of OPEX.

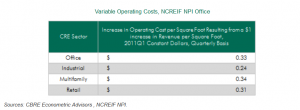

… That industrial variable costs have a lower elasticity than those of the other property types accords with what investors in this asset class generally experience: that these properties are usually cheaper to operate. A perhaps more surprising finding is that the elasticity coefficients for office, multifamily, and retail—property types with significantly different operating structures—are fairly similar to one another. We are conducting further research to better understand this finding.

See the whole piece here: What Drives Operating Costs in Commercial Real Estate?