Tom Barrack over at Colony Capital put up a nice presentation of where he sees the opportunities for real estate investment in the current market. While Colony is geared to serving their large institutional investors, those of us operating on a smaller scale can benefit from Tom’s insights as well.

My Exec Sum of the opportunities he sees that I think will impact smaller investors in North America (and my comments in parentheses):

- Commercial and residential real estate are great investments today because equities and debt are mispriced and the economy is regaining its feet. (There will be competition however).

- Distressed debt in the US is diminishing but they are continuing to resolve non-performing assets (which can create deals for long term holders as these turned around assets come back to the market).

- Single family residential for rent housing is stabilizing and becoming a institutional asset class (which can provide exits for those who have built portfolios of these properties).

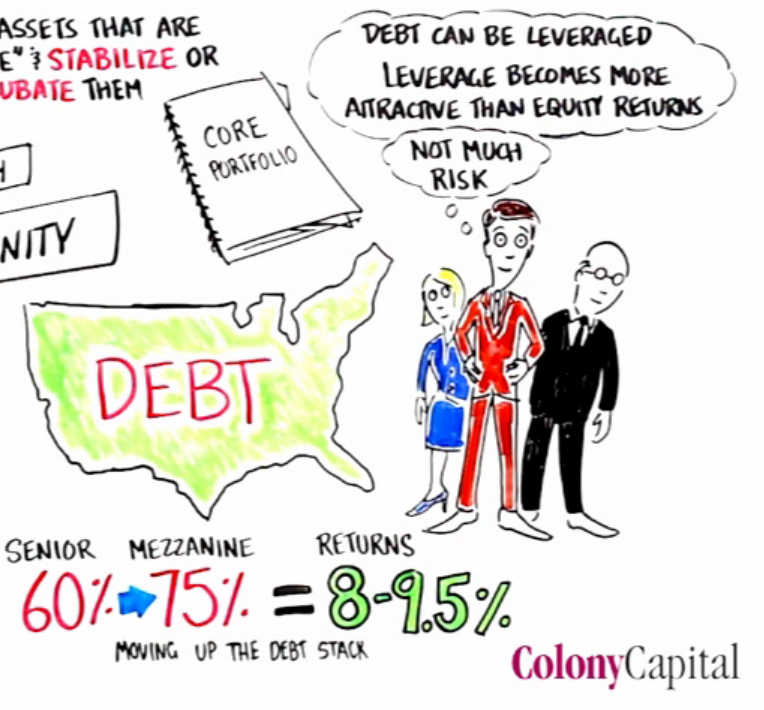

- Mezzanine debt and what he calls ‘stretched senior debt’ is becoming more available for value add & opportunistic deals because institutional investors such as pension funds need the extra yield (it will be easier to finance turnaround commercial properties at higher LTVs).