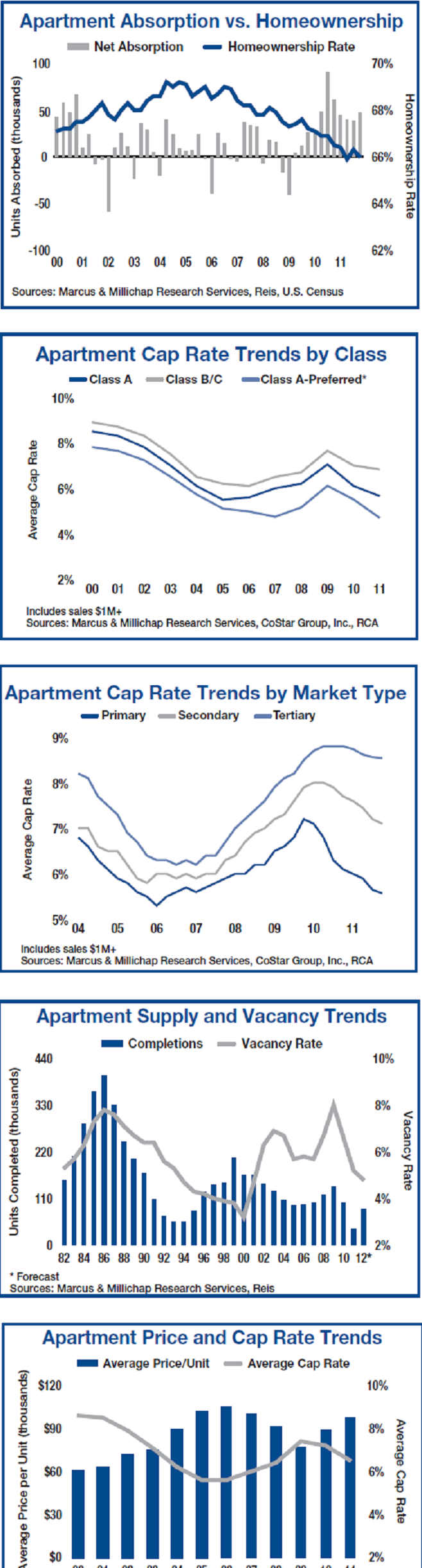

Marcus & Millichap’s latest report on Apartment Building Investment called “The Outlook” is just out today. In it they cover the usual national multifamily trends; rents up, vacancy down, economy slowly recovering, jobs growing but could be better. Then they take it a little deeper with these points (bel0w) then flesh it all out with charts demonstrating that things are really picking up for apartment building investors.

Here’s the exec sum:

- Expanding Production Capacity Signals Stronger Job Creation.

- Sustained employment growth underscores traction in the economy.

- Apartment demand surges, completions sink to new lows, and a sweeping recovery matures into an expansion cycle.

- Vacancy rates tighten across markets and asset classes, moving the sector into expansion.

- Foreclosed homes and government-sponsored REO-to-Rental program offer rental alternatives to apartments.

- Cap rate arbitrage and stabilizing operations create a compelling investment thesis for opportunistic and value-add strategies.

- Stronger job growth and household formation will provide a steady source of new entrants to the multifamily rental market.

My comments on the three points in bold–

“moving the sector into expansion” (first point) is describing where the national market is in the apartment building investment cycle; expansion being the good (for investors) part of the cycle. I will put up a detailed post on the apartment building investment cycle next week. One of my mentors, Tom Barrack of Colony Capital says knowing where you are in the cycle is the most important thing in real estate investment.

The second point is a fancy way of saying that you can get better deals on apartment buildings that need some fixing up compared to buying one in really nice shape. A ‘value-add strategy’ is where you buy a property with a problem you know how to fix, then you fix it. The problem could be low occupancy, a lack of curb appeal, poor management, lack of cost control, and so on.

Job growth and household formation are the two biggest drivers of the apartment building investment cycle. Household formation happens when young people move out of their parents into their own place, when new immigrants move here, etc.

Now the charts:

Oops, accidentally cut of the legend on the x axis of the last chart. The bars are annual, 2000- 2011.