Colony Capital has big plans for the REO-to-Rentals (RtR) sector. Not only do they want to buy 30,000 plus houses to rent them out, they also want to turn RtR into an institutional grade asset class. That has big implications for single family real estate investors who will now have deep pocketed competition that enjoys economies of scale.

Granted I was initially skeptical about single family homes becoming an institutional asset class but people said that about apartments twenty years ago too. In an interview printed in Institutional Real Estate Letter, Kevin Traenkle of Colony Capital maps out their strategy in pretty good detail, including what I think is Tom Barrack’s real genius piece, their exit plan of spinning the RtR properties off into a REIT. A number of other institutional players have told me they looked at the RtR model and fully reserved it wouldn’t clear their return hurdles. Typically private equity needs to see returns above 15% IRR unlevered over a five to seven year hold but with an operating REIT holding periods could be longer and expected returns lower since the performance benchmark would be other publicly traded REITs in the securities market. I’ve asked Kevin to comment on this subject as well as a few other things and will definitely share his responses in the comments here.

See the piece for some eye opening stats on the size of this market and a very open discussion of their market selection criteria.

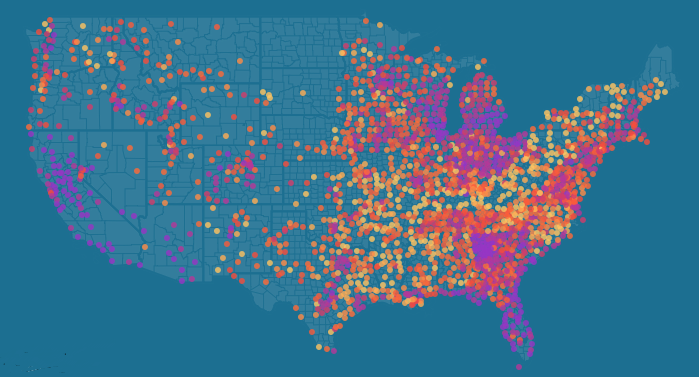

Hat Tip to Marco Santarelli of Norada for the interactive map of foreclosures.