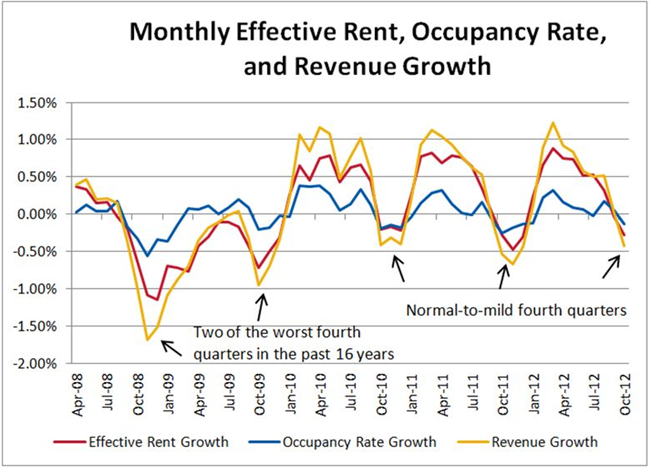

Axiometrics’ monthly apartment building investment report has a great chart showing the seasonal effects on effective rent, occupancy rate and revenue growth. How do you model seasonality in your budgets? What do you think is the best way to do this?

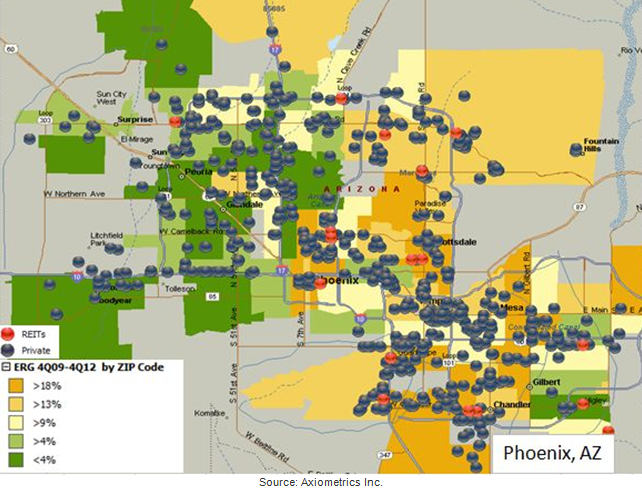

Their report this month also has a very interesting discussion of where REITs like to buy properties along with three maps showing exactly where their properties are located in Atlanta, Houston and Phoenix. Here’s PHX:

Axiometrics follows 88 apartment markets across the US and if you want to stay away from, or alternatively in the path of REITs and other institutional apartment investors having access to these maps would be pretty handy.

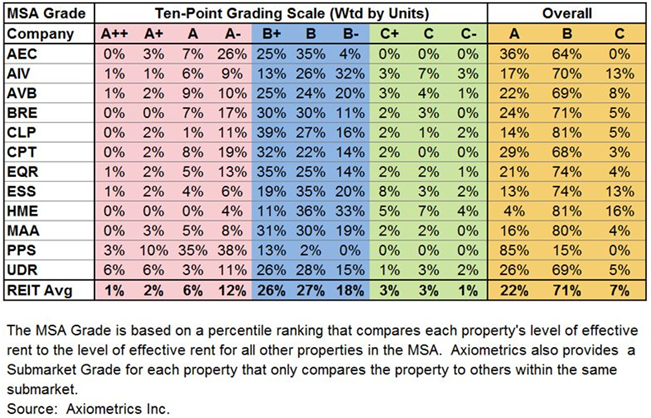

In addition their issue this month has a table showing the top 12 US apartment REITs holdings by property class. The interesting thing is that their methodology for determining whether a property is A- or B+ or C is based on the property’s effective rent compared to its competitors in the same MSA or submarket, not the flowery description from someone’s marketing department.

I have a few apartment REITs in my retirement plan and it’s interesting to compare their holdings by class. I picked up some nice dividends in the lows of ’08 and ’09, more importantly good ongoing intel on what the big players are doing. For more on Axiometrics research go to www.axiometrics.com