Marcus & Millichap’s latest report on Apartment Building Investment called “The Outlook” is just out today. In it they cover the usual national multifamily trends; rents up, vacancy down, economy slowly recovering, jobs growing but could be better. Then they take it a little deeper with these points (bel0w) then flesh it all out with charts demonstrating that things are really picking up for apartment building investors.

Here’s the exec sum:

- Expanding Production Capacity Signals Stronger Job Creation.

- Sustained employment growth underscores traction in the economy.

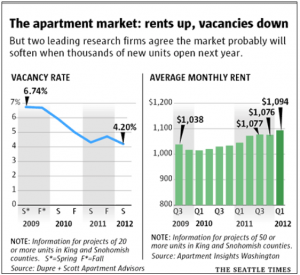

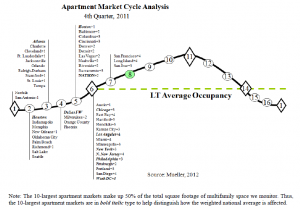

- Apartment demand surges, completions sink to new lows, and a sweeping recovery matures into an expansion cycle.

- Vacancy rates tighten across markets and asset classes, moving the sector into expansion.

- Foreclosed homes and government-sponsored REO-to-Rental program offer rental alternatives to apartments.

- Cap rate arbitrage and stabilizing operations create a compelling investment thesis for opportunistic and value-add strategies.

- Stronger job growth and household formation will provide a steady source of new entrants to the multifamily rental market. Continue reading National Apartment Building Vacancy Plummets, Defies Fourth-Quarter Seasonal Slowdown says report.