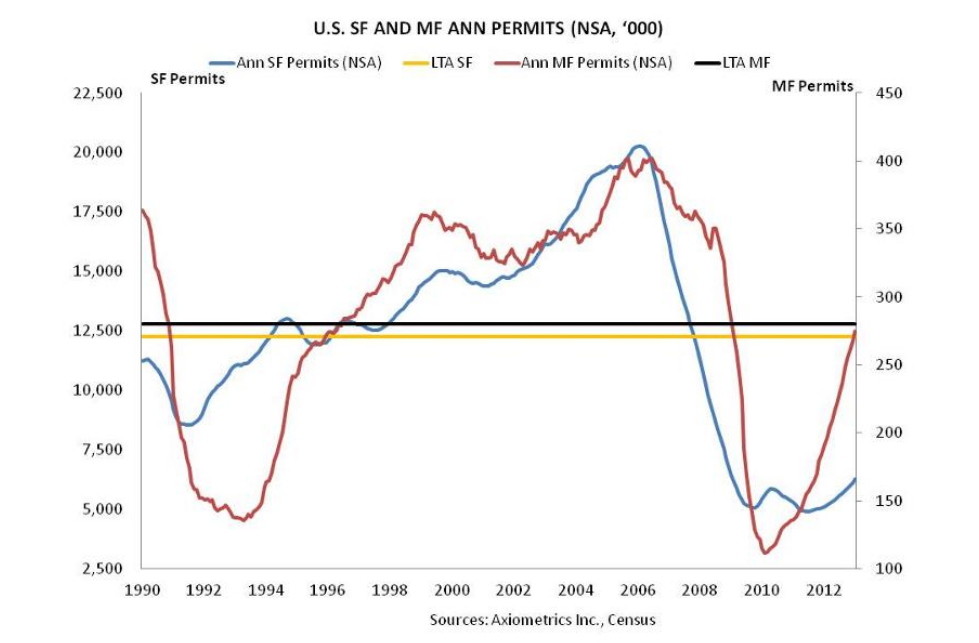

In their latest apartment building permitting report Axiometrics says: “permitting increased 44.3% or 84,308 units from the January 2012 figure of 274,640 units.” This is very near the long term average of 280,000 units, see the chart:

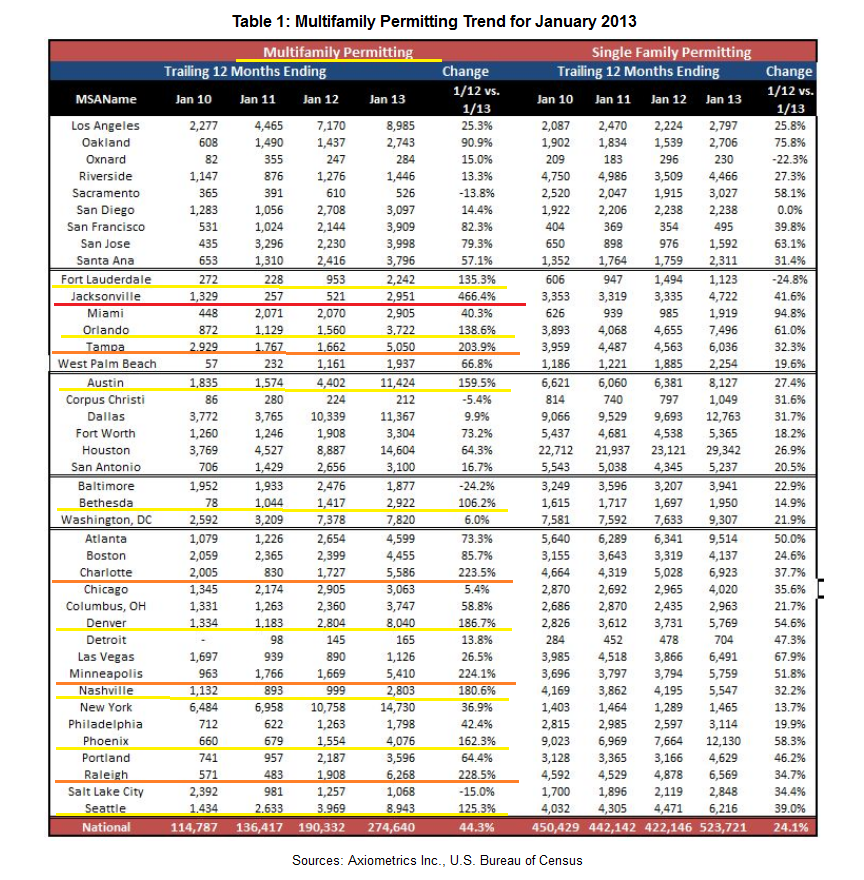

Note that single family permits are still well below their long term average. Further down in the Axiometrics report they have a table breaking out the permitting by MSA and we can see the Flaw of Averages in action. Year over year changes in permitting activity is all over the place but generally climbing. While there are four MSAs with declining permits the other 37 are up and quite a number are up significantly with Jacksonville leading the pack, up more than 450% . See my highlights on the table below:

Note that single family housing permits are up everywhere except San Diego and Fort Lauderdale while Miami is the outlier at up 95%.

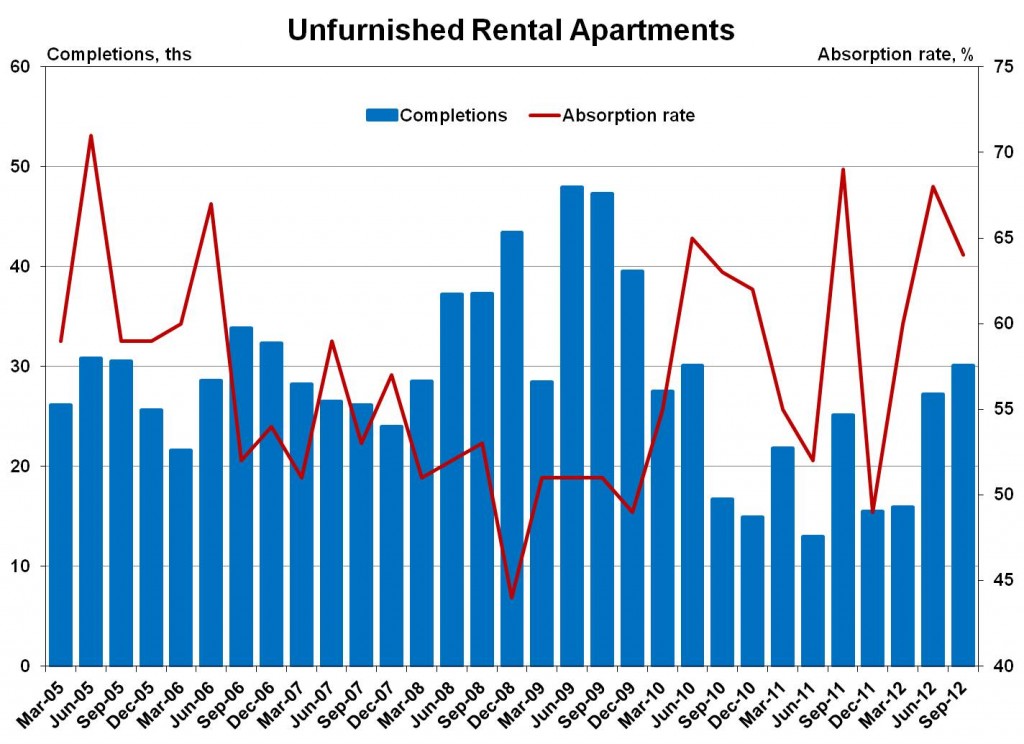

In the next chart from the NAHB we can see that completions are on the rise and that absorption is above 60% as of September last year. Absorptions data tends to be noisy so that the last tick down doesn’t necessarily indicate a change in trend, we’ll have to see the next quarterly report to get a better sense of that:

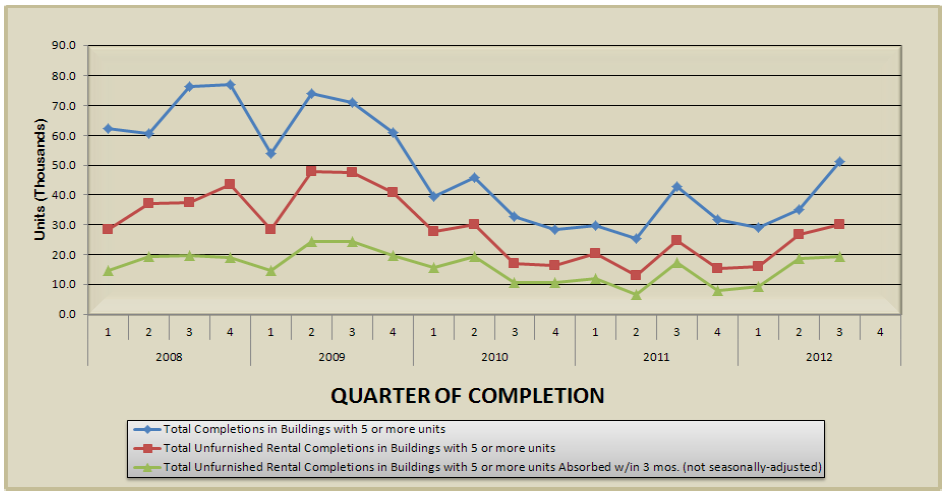

It always catches me when the NAHB says apartment construction is ‘improving’ because I tend to think less is better when it comes to construction of new units and they definitely don’t. The chart is built on data from the Census Bureau’s SOMA report (Survey of Market Absorption) Q4 2012 version with data through Q3. On the report’s main page there are links to all the data (in xls format) as well as a few charts that can be useful. One I found very helpful was the Units in Apartment Buildings Completed and Absorbed 2008 – 2012 shown here:

From this chart it looks like the spread between apartment building completions and absorption is just starting to widen over the last couple quarters that they have data for. It will be quite telling where the spread goes over the next couple quarters.

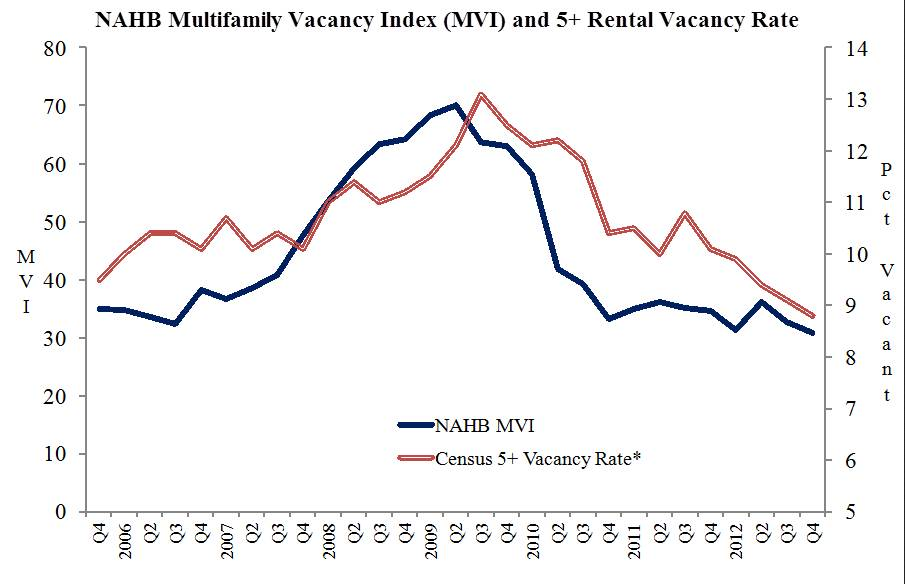

Finally this factoid caught my attention: “Historically, the MVI has tended to foreshadow the Census Bureau’s measure of rental vacancies.” It came from another NAHB piece reporting on their Multifamily Vacancy Index and the thought that there may be another good leading indicator for the apartment building investment cycle got me reading:

Unfortunately the MVI “measures property owners’ confidence in the strength of the market for existing rental apartments” which means that this is somewhat like asking race car drivers who’s going to win the race. We’ll have to see more than just six years of data before we add it to our market cycle matrix but in the meantime if it kicks up two quarters in a row it will raise a flag.

One thing in their piece that threw me was this statement: “The MVI’s indication of ongoing strength in the existing rental apartment market is also consistent with the declining absorption rates.” If construction is up and absorption is declining, how can that be good for vacancy going forward? I inquired about this and will post their reply in a comment to this post. If you have an explanation please share it in the comments.

So net-net completions up, absorption falling yet apartment building investors remain confident about vacancy rates…. hmmm.

Condos are found in South Tampa and recently there has been competition with the development of a 300-apt building.

Here’s an article I found interesting:

http://www.tampabay.com/news/business/realestate/developers-want-to-build-condo-project-in-channel-district/1276849

Craig, it’s interesting that a condo developer is crossing over to ‘the dark side’ to do an apartment project- The urban revitalization angle will pay off in the long run I believe.

I grew up in the city of Bellevue, across Lake Washington from Seattle and they used to roll up the sidewalks at night, the downtown was deserted because no one lived in the core. In the last ten years mixed-use high rise condos and apartments have turned the core into a very desirable place to live with a vibrant night-life… and people on the sidewalks day and night. It’s a huge transformation.

The city I live in now was gutted in the ’90s when major retail all moved out to the new suburban mall and while downtown living is ok one thing that will really bring it back to life is a grocery store withing walking distance of the core.

Update: Received a quick reply from Paul Emrath, PhD, NAHB VP for Survey and Housing Policy Research about my confusion mentioned in the second to last paragraph of the main post: “You are absolutely correct. That statement was an error and has since been deleted. Thanks very much for the careful reading and calling the mistake to our attention.” Thanks Paul for your quick response.

I agree- I think less is better when it comes to construction of apartment rentals.

Thanks Craig, how much new condo construction are you seeing in Tampa? Is there competition between condo developers and apartment builders for property?

A couple supporting tidbits from the ULI’s Real Estate Business Barometer:

Apartment sector completions soared past the long-term quarterly average; rents ticked up to a new all-time high.

Multifamily permits moved up a bit and starts dipped, but January’s levels are a whopping 38 percent and 49 percent, respectively, above those of January 2012.

Overall, 63 percent of the key indicators in the Barometer have improved from the previous month’s Barometer; compared with a year ago, 82 percent have improved.

Click here see the ULI article on their Real Estate Business Barometer.