…In its investment cycle?

Well Integra Realty Resources (IRR) is just out with their 2015 Viewpoint Report covering where they think things are and where they might be headed in the five major sectors of Commercial Real Estate (CRE); office, industrial, retail, multifamily and hospitality… as well as a bonus piece on self-storage. IRR is one of the largest independent commercial real estate appraisal firms in the U.S and this is their 25th annual IRR Viewpoint in the fifteen year history of the company according to their chairman in his introduction. Not sure on the math there but I do have their reports going back to 2002.

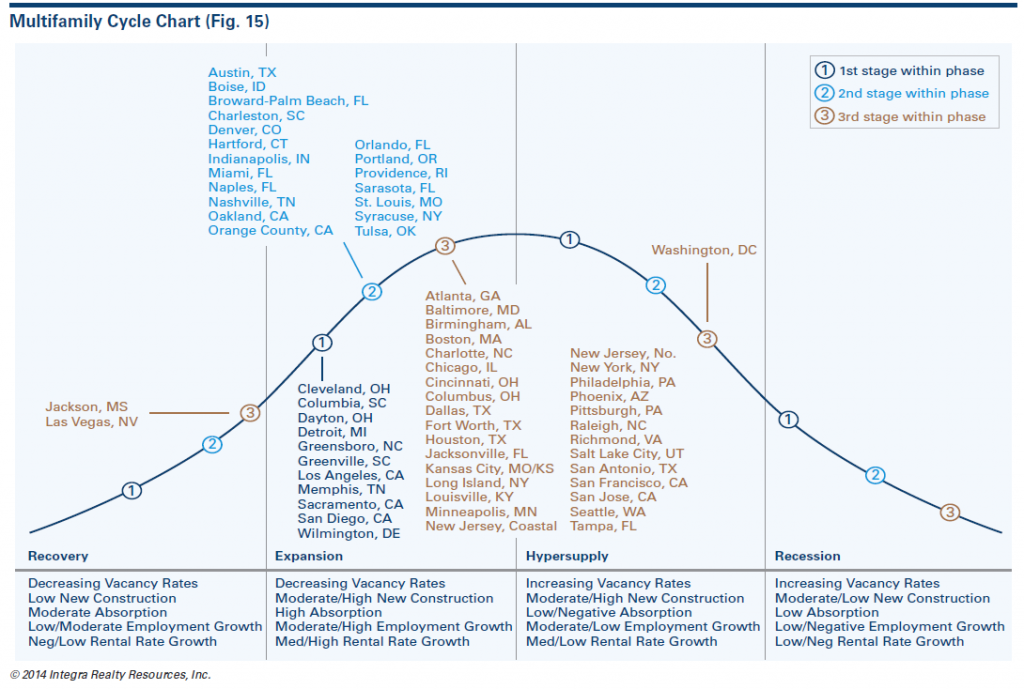

In the report they cover cap rates, going-in cap rates, discount rates, yields, reversion rates and much more but the first thing I look at is their market cycle chart for the multifamily sector:

So IRR has an idea of where your apartment market is, provided your market is in one of the sixty plus places where they have an office. The big question is do you agree with their placement? It is very important to review the data and form your own idea on this because there are good reasons to doubt their placement of at least some markets some of the time as I will show in an upcoming post. . I used to look at this report to get an idea of where different markets were in their cycle but now I look to see if one is badly skewed based on the data I’m seeing.

In this year’s report they have Seattle which is one of our markets (along with about half of their other markets) at stage three of the expansion phase and I would buy off on their placement but that hasn’t always been the case. In some periods they seemed to be way behind the curve, especially on the upswing in the cycle and that’s critical for the buy low portion of the buy low/sell high strategy that most investors intend to follow.

In that post I’ll be looking at a number of the markets we’re in but if you spot one that is out of whack with what you’re seeing on the ground let me know in the comments and I’ll be sure to include it as well.

Good hunting-