Bill McBride over at Calculated Risk stares at this stuff all day and has a pretty good track record reading the Fed’s tea leaves. He believes that actual ‘tapering’ of QE3 purchases most likely won’t start before December although there is a slight possibility that it could happen in September if…..

- 3rd Qtr. GDP rose enough to make 2013 growth look like it will hit the low to mid 2% range.

- Unemployment would have to dip enough to make it likely to get down to 7.2%-ish by year end.

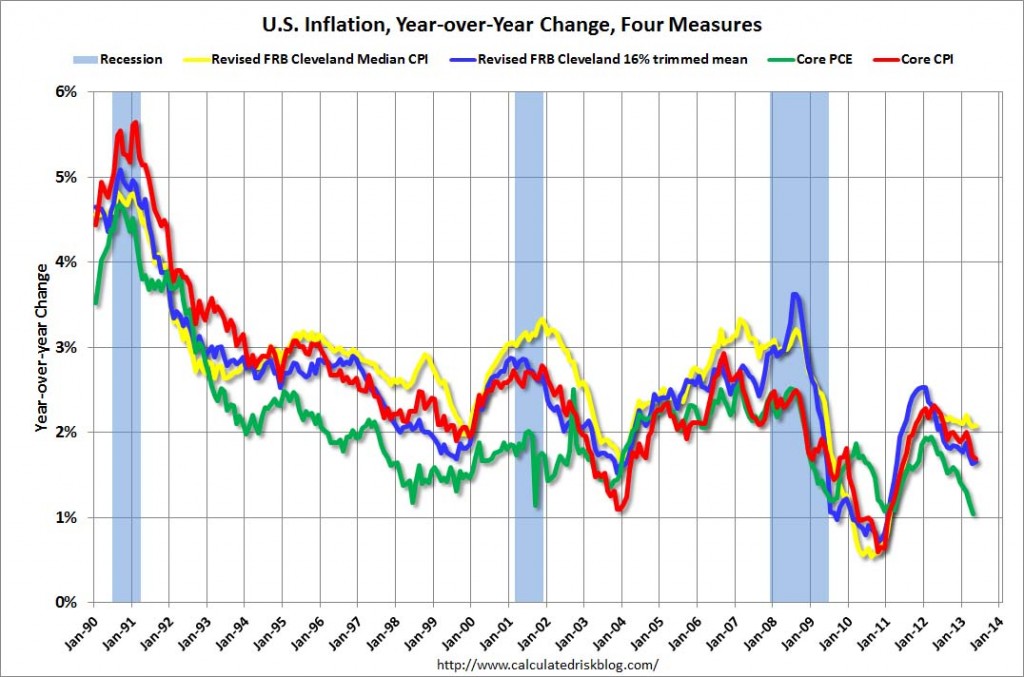

- Inflation has to be increasing. Currently the trend is in the wrong direction and Q1 produced only .3% which is well below the 2% annual the Fed Wants.

See Bill’s analysis here: Analysis on Tapering QE3 I highly recommend following Bill’s blog and this is just one of several posts in the last week on Fed comments around the end of tapering. Here’s the inflation chart he posted last week showing four different measures of inflation, note the trend since the beginning of the year:

Of course none of the Fed’s comments were interpreted this way by bond traders, what they heard was: It’s the end of the Continue reading Analysis on Tapering QE3 by Bill McBride- Not until December but #Multifamily rates jumped 45bp anyway