What comes after primary, secondary, tertiary apartment building investment markets? I got to thinking about this after I read that MPF Research classifies a tertiary market as one with up to 100,000 units…. so I looked it up on the intertubes:

The sequence continues with quaternary, quinary, senary, septenary, octonary, nonary, denary. Words also exist for `twelfth order’ (duodenary) and `twentieth order’ (vigenary) according to www.answerbag.com

Tag: CRE

What do I do with my retirement money, one investor’s answer (with charts). Think apartment building investment-

Good charts on long term returns in this piece from Glenn R Mueller, PhD.:

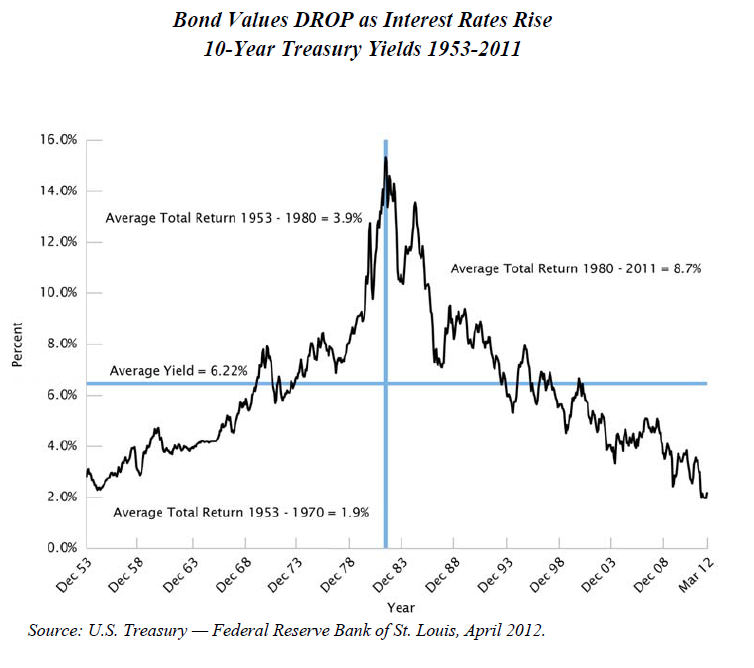

I recently met with my financial advisor to “rebalance” my … retirement portfolio. Based on my “age and stage of life” his allocation model showed a 50% bond allocation. I laughed and asked him if the company allocation model assumed interest rates would rise over the next 10 years? His answer was “yes- of course.” I showed him the graph below which shows lower than average TOTAL returns in a rising interest rate environment and he checked his long-term data and found that bond holders between 1953 and 1980 had actually lost money. We all know that as interest rates rise, bond values decline and thus the total return can be small or negative. Not to mention that a 10-year treasury at 1.5% is below expected inflation and thus a NEGATIVE REAL RETURN. He agreed that a bond allocation did not make much sense, but since my investor profile was conservative what was the alternative?

Dr. Mueller is Continue reading What do I do with my retirement money, one investor’s answer (with charts). Think apartment building investment-

PIMCO calls bottom in housing, but likes REOs-to-Rentals over apartment building investments?

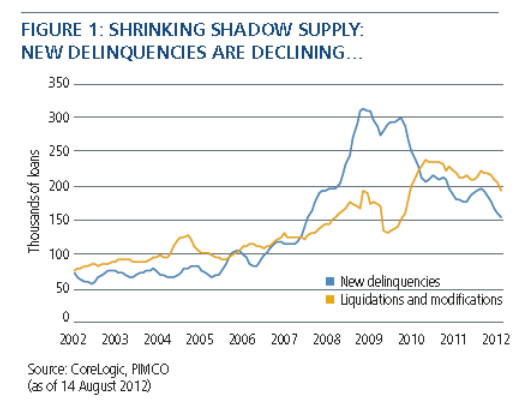

In a piece called Positioning for a Housing Recovery PIMCO says that the risks to housing have been overstated and while prices may continue to fall there are opportunities in the mispricing of that risk. They believe that the risk of the 11 million underwater home loans all becoming delinquent and going into foreclosure is much lower than most think. They also point out that the record low interest rates have created housing demand from large institutions (Like PIMCO, and individual investors too) searching for positive returns.

One of the opportunities they list is in apartment building investment, either through equity (owning) or debt (loaning). However they pass over multifamily in favor of REOs-to-rentals and distressed housing debt. It’s ironic that they would favor buying large numbers of single family homes to rent because the logistical nightmare of the scattered homes is what drives most real estate investors to apartments and other commercial real estate. The convenience of having 10, 20, even 200 units or more at one location on a single property on top of the economies of scale available make owning multifamily a much better investment.

While they do acknowledge the challenge of REOs-to-Rentals:

However, investors must be mindful of the operational complexity and illiquidity of a single-family rental portfolio. Managing a nationally diversified portfolio of rental properties presents unique challenges of surveillance and scaling, and procedures for maintenance and leasing must be designed to help protect earnings.

… Somehow that doesn’t lead them to picking multifamily investment. Are you a real estate investor who started out in single family properties and moved on to apartment buildings? We would love to hear your story-

Hat tip: The Big Picture blog

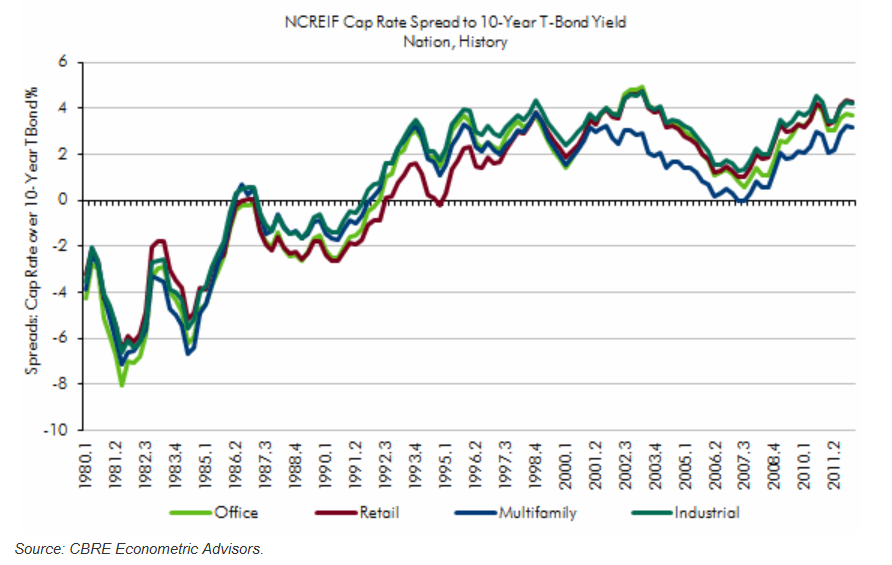

The shape of the entire yield curve drives #CRE pricing, not single Treasury rate- CBRE Econometrics

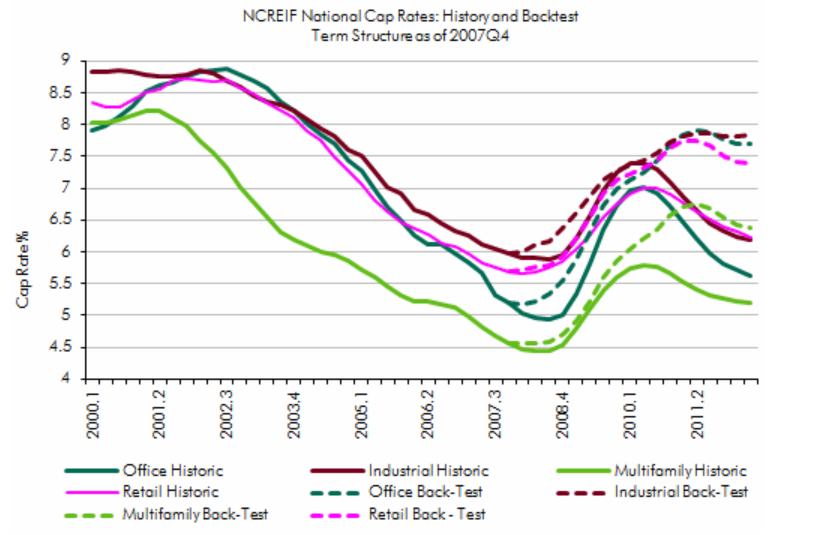

Research out from CBRE Econometric Advisors shows that the typical risk-free benchmark rate, the 10 year Treasury, does not accurately reflect the cost of capital risks in asset pricing for commercial real estate. The whole yield curve or ‘term structure’ should be used instead. Highlights from their report:

- Our research shows that it is not a single risk-free rate that drives asset pricing, but rather the entire term structure of interest rates (also referred to as the shape of the yield curve; we use these terms interchangeably). This term structure effect is so strong that relying upon a single benchmark rate in one’s analysis (as is typically done by analysts and investors) is inappropriate. We will demonstrate this below, using our empirical model of cap rates.

- Secondly, the shape of the yield curve affects investors’ expectations of future interest rates and therefore their investment and pricing decisions. For example, during periods with a flat yield curve, investors may reasonably expect the term structure to revert to its long-run value, with the resulting Continue reading The shape of the entire yield curve drives #CRE pricing, not single Treasury rate- CBRE Econometrics

The One Shoe That Didn’t Drop in The Financial Collapse- Commercial Mortgage-Backed Securities. #CRE

Heidi N. Moore was talking with a investor who specializes in buying distressed commercial mortgage-backed securities (CMBS) and I was reminded of something Warren Buffett said back in 2007:

“When people start dropping shoes you really don’t know whether they’re a one-legged guy or a centipede.”

The investor was saying that the commercial real estate (CRE) market has been under the same pressure as the housing market but the CRE market hasn’t crashed. Why hasn’t that shoe dropped… and why won’t it?

The investor said that CRE was “rife with all the same corruption as the housing market: banks didn’t do their homework before signing loans, ratings agencies were overly generous in classifying weak loans as strong, but when it came [time] to mark down the value of the struggling commercial real-estate loans, many banks simply refused. They inflated the values of the loans to make their balance sheets look good.” [And therefore could keep all their bailout funds at work speculating in derivatives and jacking their bonuses instead of being set aside to cover losses.]

There are two other reasons that the CRE market and the CMBS tied to it didn’t crash: 0% interest rates, which means commercial borrowers weren’t punished with higher interest payments; and more importantly Continue reading The One Shoe That Didn’t Drop in The Financial Collapse- Commercial Mortgage-Backed Securities. #CRE

UPDATE: Top 10 US Submarkets for new apartment building units in the pipeline.

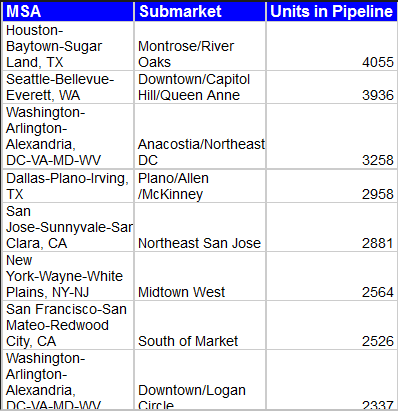

In May we posted an article Top 10 US Cities for new apartment building permits where Seattle came in sixth in new apartment building units permitted. Now a new list is out from Axiometrics with a breakdown by submarket and Seattle’s Downtown/Capitol Hill/Queen Anne submarket lands at number two with almost 4,000 units due to come on line in the near future.

And that’s on top of nearly 6,000 units (3,500 in the last two years) that have already been delivered downtown since 2005. Plus there are several other hot neighborhoods such as Belltown and South Lake Union that Continue reading UPDATE: Top 10 US Submarkets for new apartment building units in the pipeline.

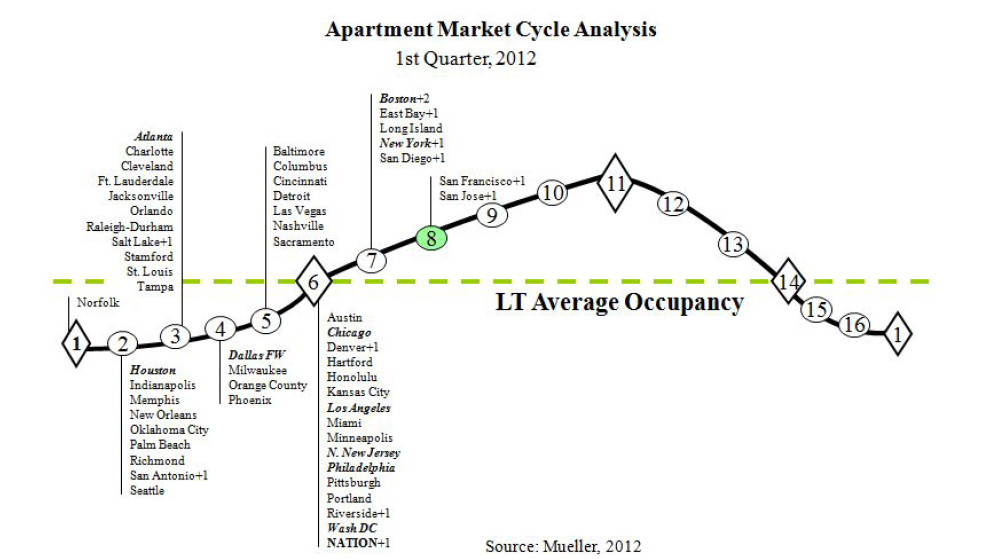

Updated CRE and Apartment Market Cycle Charts Now Posted by Glenn Mueller at Dividend Capital

Dr. Mueller is one of the leading researchers on the commercial and apartment building investment cycle but I have big questions about Seattle being placed at the bottom of the cycle in his latest Cycle Monitor report. According to MPF Research there currently are 6,000 new units under construction in Seattle (see here) and Essex Property Trust estimates that there will be 10,000 units coming on line in the next three years (see here). In fact the NMHC lists Seattle as one of three US markets in danger of overbuilding (see here).

Reis Reports is showing that while rents are up about 1% QoQ in Q1 2012, vacancy is starting Continue reading Updated CRE and Apartment Market Cycle Charts Now Posted by Glenn Mueller at Dividend Capital

Research shows that Apartment Building and CRE cap rate spreads shouldn’t be modeled as constant

From Serguei Chervachidze, Capital Markets Economist at CBRE Econometrics: “What’s the long-term spread between cap rates and Treasurys?” This question, with a few variations, comes from all types of clients—from small investment shops to large hedge funds staffed with many quants.

This is the wrong question to be asking, however, in that it assumes Continue reading Research shows that Apartment Building and CRE cap rate spreads shouldn’t be modeled as constant

Commercial Real Estate added $260 Billion to GDP last year- Hessam Nadji video via Marcus & Millichap

See the video here: http://bit.ly/JpqMck Sorry, couldn’t figure out how to load their video directly into this post. Any suggestions? Thanks.

The 10 Commandments of Network Building by Duke Long

Duke is one of the top thought leaders on how commercial real estate (CRE) and online social networking should work together… and where they don’t. HE posted this on his blog 10 Real World Examples of How I Built My Commercial Real Estate Network and in an ironically karmic sort of way I just saw it on Klout’s homepage today. It is so good and to the point in true Duke style that it would be a great guest post. I believe these steps work online and off, in CRE or any other industry so take it away Duke:

1.What are the relevant commercial real estate communities of interest? What are the needs wants of the participants within these communities?

I started simply looking for the groups and associations that I already had and affiliation with. My state commercial board. NAR because I had already made several connections over the years. CCIM,SIOR,IREM,BOMA etc. Why connect? Hell, why go to the meetings and get on the conference calls, why volunteer? I needed build and cultivate a network. Online connection was a revelation. I would listen learn and ask simple questions. The needs and wants were pretty obvious.People wanted to connect to make deals. But then something interesting started to happen.Human interaction.

2.Participate where your presence is advantageous and mandatory, don’t just participate anywhere and everywhere or solely in your own domains (Facebook,LinkedIN, Twitter conversations related to your brand, etc.)

Seems pretty obvious does it not? Let me give you and example. I do everything in my power to eliminate and and all feeds emails discussions and spam from lenders. You say What? We need that lender connection. Not me. All and I mean all they do is spam and pitch. How does this help me or my clients. You would think lenders pitching brokers is a natural fit. Wrong. Go find the client before they get to me and leave me the hell alone. The “we only are taking clients in the 30-75 mil bracket ” pitch is total bullshit. So, your are in commercial real estate who and where should you be ? Start-ups, Logistics Companies, Medical Associations,Industrial Data Centers…let your brain flow.Maybe some other brokers also they need to know what your stuff is but not in a spammy way!

3. Determine the identity, character, and personality of your Continue reading The 10 Commandments of Network Building by Duke Long