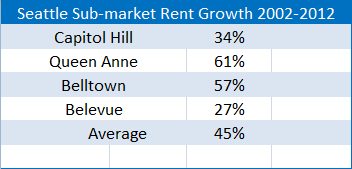

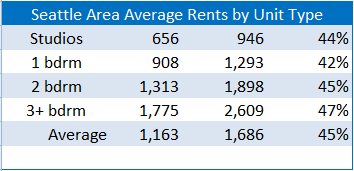

A piece on Seattle apartment building rents over the last ten years by Matt Goyer in his Urbnlivn blog really caught my eye. Matt looked at data from seattlerentals.com for four popular sub-markets and charted them out here. Naturally I wanted to see what that meant percentage-wise so I built a spreadsheet and added a percent change column. Here’s what that looks like:

All within a stone’s throw of 45% growth in 10 years, not bad at about 3.8% annual compound rent growth. But let’s slice the data another way and look at the rent growth by sub-market:

Now we start to see some divergence with Queen Ann at 61% (4.86% compound) and Belltown with 57% (4.59%). Where the ‘average’ rent growth really looks good is when it’s compared to Capitol Hill with only 34% (3.01%) and in Bellevue with only 30% (2.42%). Mind you that is just the ‘average’ 10 year rent growth for these markets so it’s only an indication of what any particular property may have achieved. But here’s where the numbers get really interesting: Continue reading The Danger of Averages: Seattle Apartment Rents by Unit Type 2002-2012