In many top US markets the supply of office space has not just been stagnant, it’s actually been shrinking and apartment building investors have been the beneficiaries.

In a CoStar piece out today entitled Didn’t That Used to Be an Office Building? they list a couple big advantages of converting office space to apartments: Office working residents are close to work, and there’s great access to public transportation. How many people who spend hours a day sitting on the freeway would like the option to park the car all week?

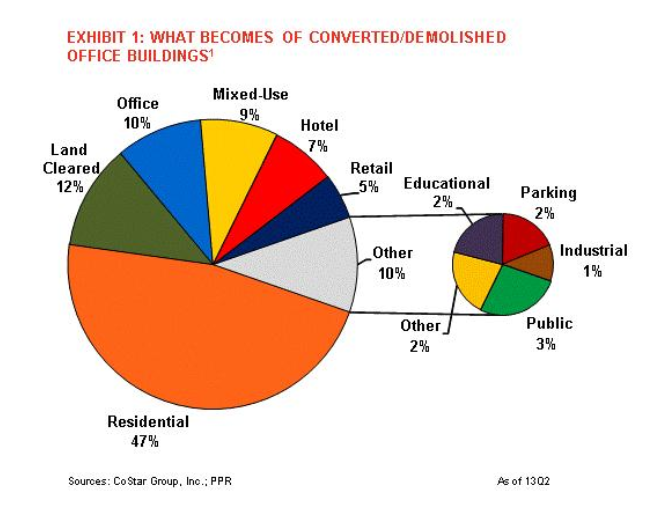

If you combine the residential and mixed use portions of the chart below, 56% of the office conversions/demolitions are going to apartments:

An interesting fact Continue reading Apartment investors and residents big winners in office building repurposing. – chart