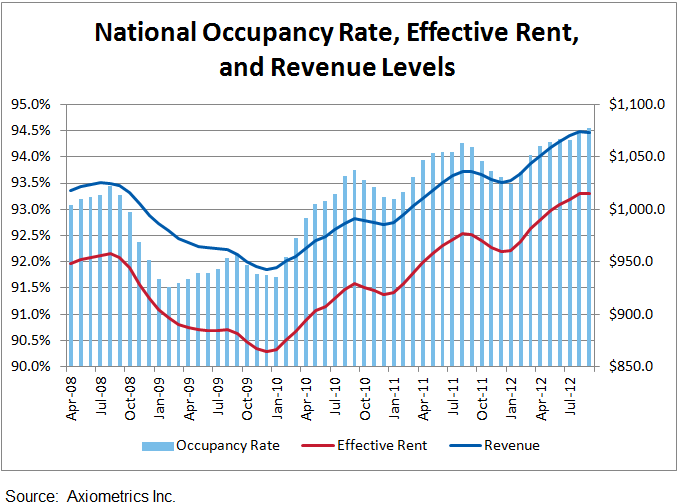

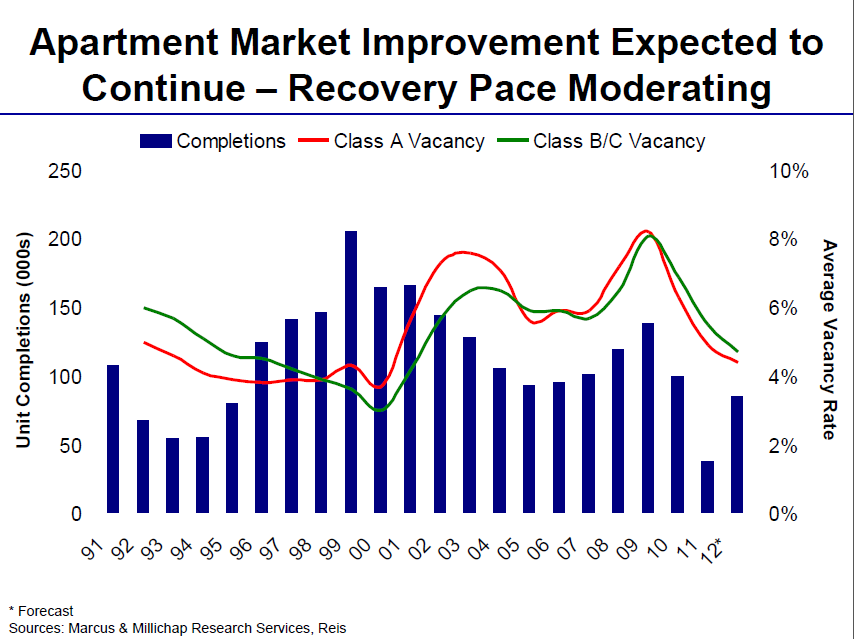

Dividend Capital’s latest Market Cycle Charts have been posted for the four commercial real estate sectors they follow, office, industrial, apartments and retail. These are published quarterly and back in June I expressed serious reservations about where they had placed the Seattle apartment market in the cycle on their last report. This quarter they still have Seattle at the bottom which is striking because of all the reasons mentioned in my June post but also because occupancy has fallen below 5% (see here).

I really don’t think that this market is at the bottom of the cycle and it leads me to wonder if Seattle apartments are the only market out of sync with reality in their reports or if there are others too. Is it bad data on one market or is it more widespread? Is it bad methodology?

Please have a look at their chart for your market and let us know if you think it’s accurately placed in the cycle. Thanks in advance, I really appreciate your help on this.