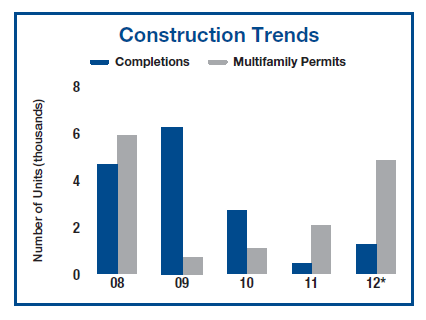

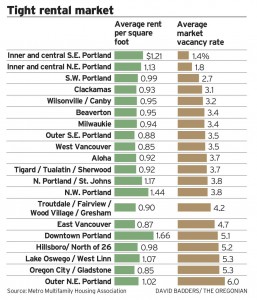

As the next building cycle for the Portland area is still another year out, vacancy rates are expected to fall to historic lows across the metro. The overall vacancy rate will match the lowest on record at 2.7 percent, while the area’s lower-tier vacancy will fall to as low as 2 percent.

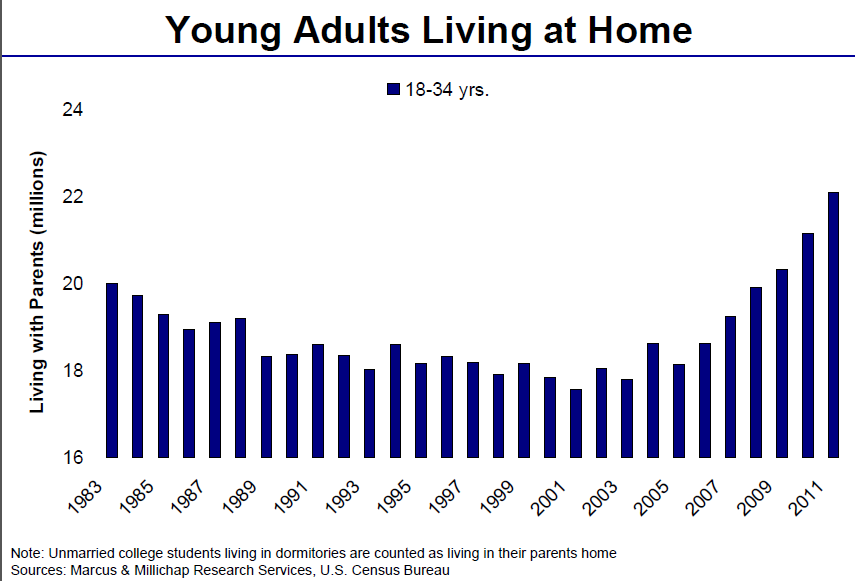

Marcus & Millichap notes that a lack of multifamily construction and the expansion of jobs in the region will be the prime factors behind the extraordinarily high rates of occupancy. Job growth is expected to rise 3.1 percent—from 20,500 positions created in 2011 to 31,000 positions created in 2012. Of particular significance will be the development of a new Intel facility, which is expected to create thousands of construction jobs and spur large demand for Class B and C apartments.

Cap rates for trophy buildings are likely to average in the high 4-percent range, with Class A and B assets in Continue reading Portland Apartment Market to add 31,000 jobs this year, vacancy to fall below 3%.