See the video here: http://bit.ly/JpqMck Sorry, couldn’t figure out how to load their video directly into this post. Any suggestions? Thanks.

Tag: apartment market cycle

Q2 Local Metro Apartment Building Investment Reports Now Posted.

M&M tracks 40 metro apartment investment markets and delivers quarterly reports on occupancy, rents, absorption, new construction and permits (See list below). You may have to register with them to access the reports.

If you have questions about a specific market Continue reading Q2 Local Metro Apartment Building Investment Reports Now Posted.

Stealth concessions in large US cities = falling apartment building rents? See the list via MFE Magazine

This was an eyeopener for us in the apartment building investing business: Large US cities with falling rents. The table is from TransUnion, I wonder what their sampling methodology is- And I wonder how that breaks out by asset class.

Yes of course there are cities with rising rents but Denver rents down almost 9% in a year? In 2011? Even Chicago down almost 5%? And DC the apartment hotbed has falling rents? Supposedly their data comes from managers supplying info for tenant screening and if that’s the case it seems like there are some serious concessions being given.

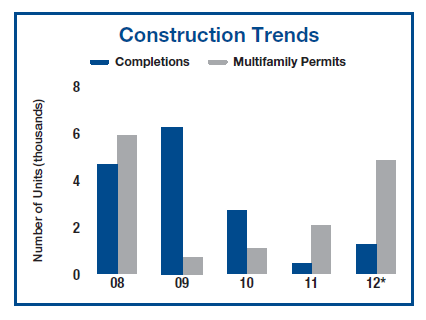

Are we overbuilding multifamily already? Or just the wrong kind? Research from CBRE Econometrics

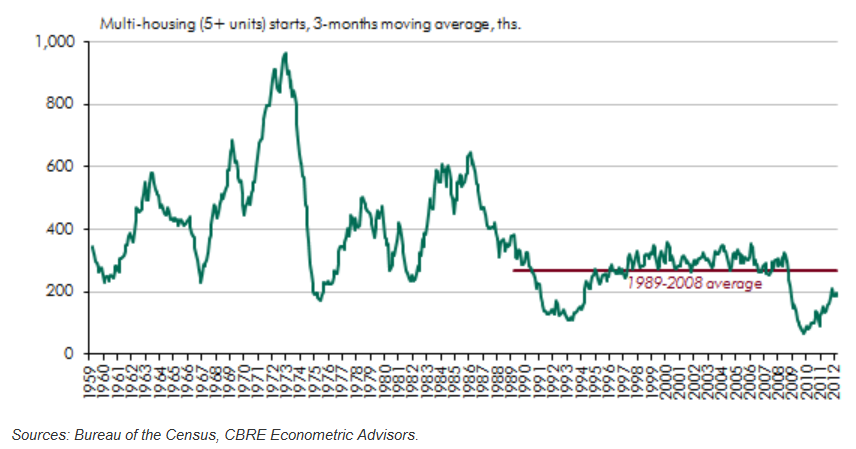

At a Seattle apartment building investment conference recently one of the main speakers was saying that everyone who’d ever held a hammer, and their brother, was trying to build apartments in that market. That really struck a nerve in my market cycle conscious brain and was looking to get some perspective on that when a CBRE piece crossed my desk with this chart on it:

So while new unit construction starts are up significantly from the 2009 lows they are still well below the 89-08 average of about 250k. More importantly in relation to demographics we will be seeing increasing demand from growth in two of the prime renter groups, my exec sum from the piece below: Continue reading Are we overbuilding multifamily already? Or just the wrong kind? Research from CBRE Econometrics

Portland Apartment Building Market: occupancy drops but rents still rising according to report

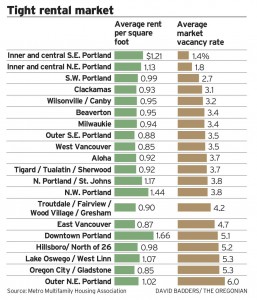

Apartments are a little easier to come by in the Portland area, but that’s not slowing down rent increases across much of the market.

According to the Metro Multifamily Housing Association which released its latest survey Wednesday:

- Vacancy across the metro area grew to 3.72% from 3.34% late last year.

- Rents climbed 3% in the same period, reaching $1 a square foot per month across the metro area.

- Average two-bedroom unit now rents for $771, up $28 a month compared with six months earlier.

The Portland area has one of the lowest Continue reading Portland Apartment Building Market: occupancy drops but rents still rising according to report

Will REO-rentals Really Compete With Apartment Building Investments?

Greg Willett, VP of research over at Real Page wrote a nice piece on that which covers it nicely; take it away Greg:

Thanks to one sentence uttered by Warren Buffett and some major overplay by the media, single-family rentals are a hot investment choice now. Thus, the analysts at MPF Research are fielding a constant stream of inquiries about whether the bulk sale of bank-owned single-family homes to investors who will operate them as rentals will impact the apartment sector.

Our take is that Continue reading Will REO-rentals Really Compete With Apartment Building Investments?

Handy Apartment Building Investment Market Reports- interactive one-pagers from Reis Reports.

Reis puts out these really handy one page reports with all the major QoQ changes broken out by sub-market. Here’s the latest on Portland, OR:

Click on the image above to go to a list of markets then select Continue reading Handy Apartment Building Investment Market Reports- interactive one-pagers from Reis Reports.

Portland OR Q1 Apartment Building Investments Now Posted.

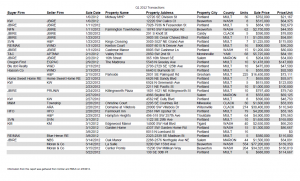

Here are some interesting transaction statistics for 1st Quarter apartment building investment transactions:

- Average price per unit was up 11% from Q1 2011

- 6.86% was the average cap rate, vs. 7.07% in 2011

- 77% of properties sold had between 5-50 units

Click on the image to see the list of Q1 apartment building investment sales in Portland:

For more on PDX apartment building investment see City Rents Rise As Buyers Wait Out Housing Bust from Joseph Bernard Investment Real Estate.

Why now is the right time for CRE and Apartment Building Investment. Video via Tom Barrack at Colony Capital

Tom is one of my mentors and I follow what he’s doing closely to learn from a pro in apartment building investing. Here’s a video 3fer with Tom on why now is the time, if you have any contrarian testosterone as he puts it (in other words you are a true value investor). See also my notes below with the exec sum in bold.

1st Video:

Tom Barrack on CNBC last week

Stock markets rise and fall, but investors with a long-term view will make money, real estate investor Tom Barrack of Colony Capital is a “slow money guy”. Barrack has $27 billion invested in real estate and $45 billion in assets around the world.

Overall in the US

Where I think we are is actually a great Continue reading Why now is the right time for CRE and Apartment Building Investment. Video via Tom Barrack at Colony Capital

Is the Dallas/Fort Worth Apartment Building Investment Cycle Peaking or just taking a breather?

In their RECON report The Real Estate Center @ Texas A&M quotes The Dallas Morning News on apartment building investment in the DFW market:

“Apartment leasing in Dallas-Fort Worth dipped for the first time in over two years.

Net leases fell by 270 during first quarter 2012, with most of the declines occurring in the northern suburbs.

Greg Willett of apartment analyst MPF Research believes the slight dip is nothing to worry about.

“I don’t think one quarter of slight resident loss should be viewed as a big deal, especially when demand in first quarter usually is pretty mild anyway,” he said. “The job numbers still look good, and a comeback for the for-sale housing sector actually could drive them higher.”

The North Texas area has added about Continue reading Is the Dallas/Fort Worth Apartment Building Investment Cycle Peaking or just taking a breather?