Apartment building investors should be looking at renovation, value add and repurposing deals according Freddie Mac’s David Brickman, EVP for Multifamily Business. In an Executive Perspective note published last week Brickman covered these points:

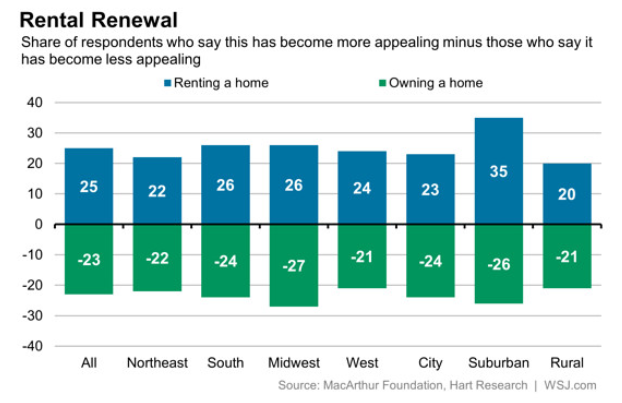

- Demographic forces alone could create as many as 4.7 million more renter households by 2023.

- That even the 3.1 million new units expected over the next 10 years will not be enough to meet demand.

- Compounding the issue, the existing rental housing stock is aging. Nearly 60 percent of U.S. rental properties with 20 or more units were built before 1980.

- Supply already could be 1.5 million

Continue reading Value Add Deals Needed To Keep Up With Apartment Building Demand- Freddie Mac