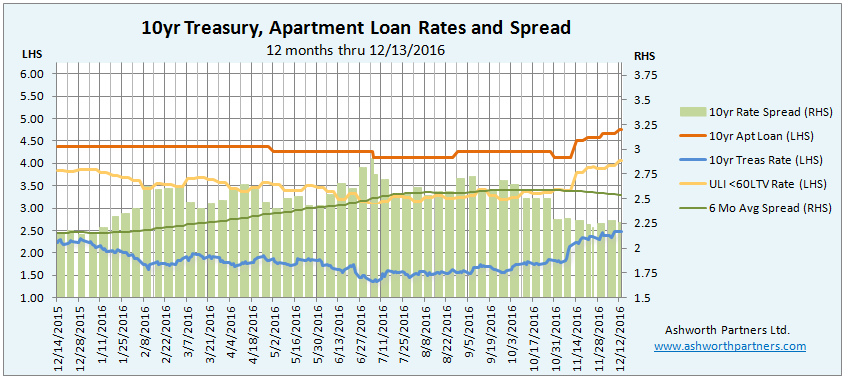

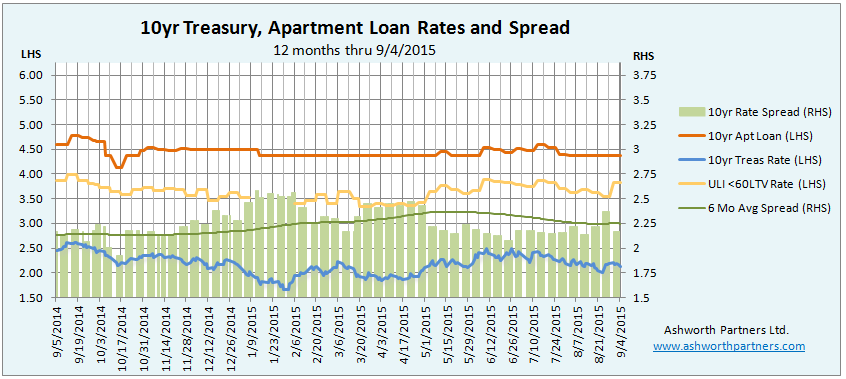

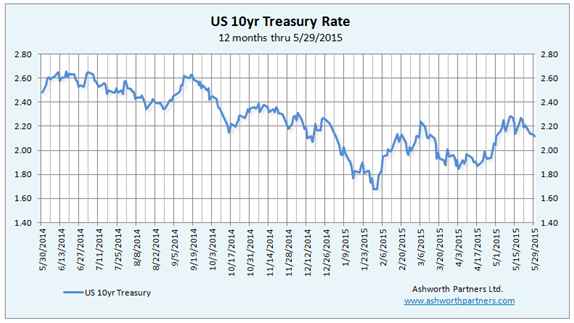

The 10 year apartment building investment loan rate we track moved up to 4.454% from 4.375% yesterday after flatlining at the old rate since the middle of January:

Even so it is still below what we used to think of as the 4.5% floor for this rate. Meanwhile the ULI rate has been tracking the 10yr Treasury, rising from 3.37% April 20th to 3.76% yesterday, a climb of almost 40 basis points.

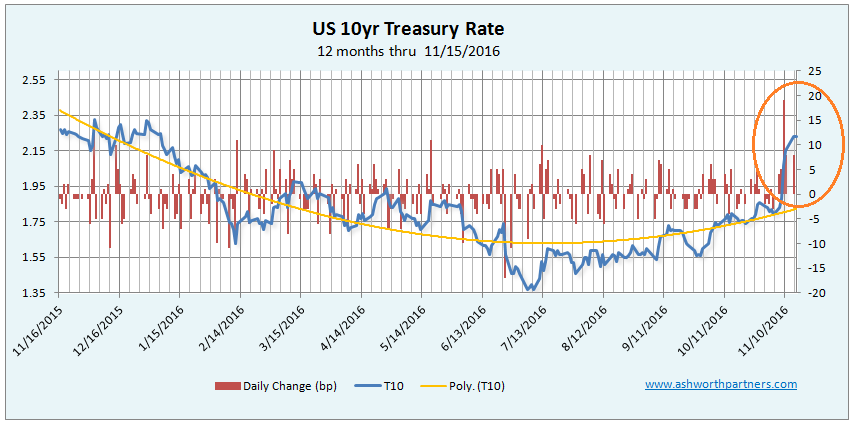

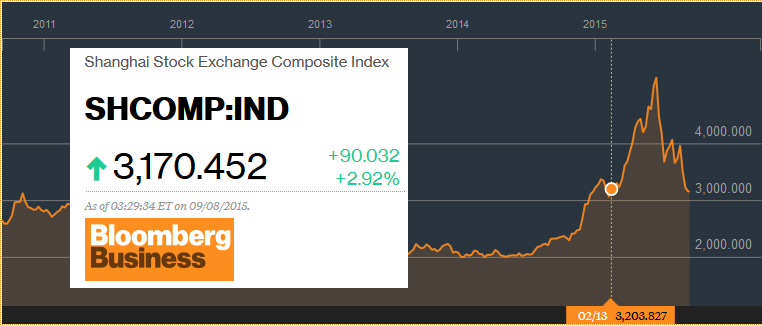

Is this the beginning of the long anticipated (The 3rd or 4th year in a row that everyone’s known rates were going to rise) rate hikes? It makes sense that the Fed would like them to get up off the floor if for no other reason that they would have room to lower them again when they needed to. But is now the time to do that when China, Europe and the rest of the world are slowing down?

While the US economy has been Continue reading 10yr #Multifamily Investment Loan Rate Comes Back to Life, Rises 7.9 Basis Points