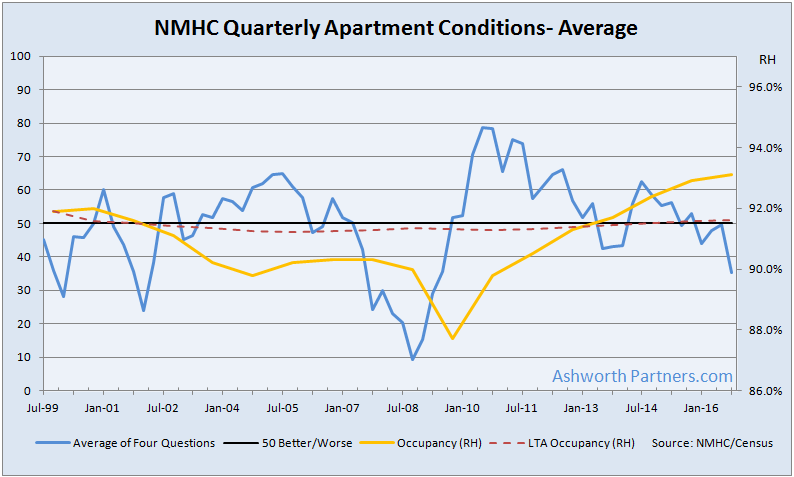

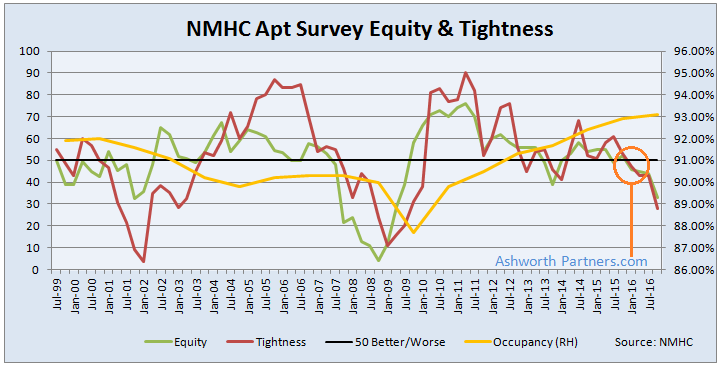

The latest National Multifamily Housing Council Apartment Conditions Quarterly shows the average fell 15 points to 35, dragged down by Sales Volume dropping to 42 from 50 and the more volatile Debt Financing which descended to 38 from 62. Market Tightness (occupancy & rent growth) and Equity Financing which were already below 50 last quarter both fell further, to 38 and 33 respectively.

Note that both Equity Financing and Market Tightness have been below the better/worse breakeven 50 level since January of this year:

Are these signs of the cycle peaking? Note also that apartment occupancy according to the latest Census figures is up only 20 basis points to 93.10% year over year. As a national average ninety-three percent occupancy is the highest it’s been since 1983 so pretty good in the larger scheme of things but taken together maybe that’s my Spidey Sense tingling.