Invictus over at the Big Picture Blog had a chart rich article last month called “Bill Gates walks out of a bar – Of Means & Medians” that explored some of the causes for the slow economic recovery in the US.

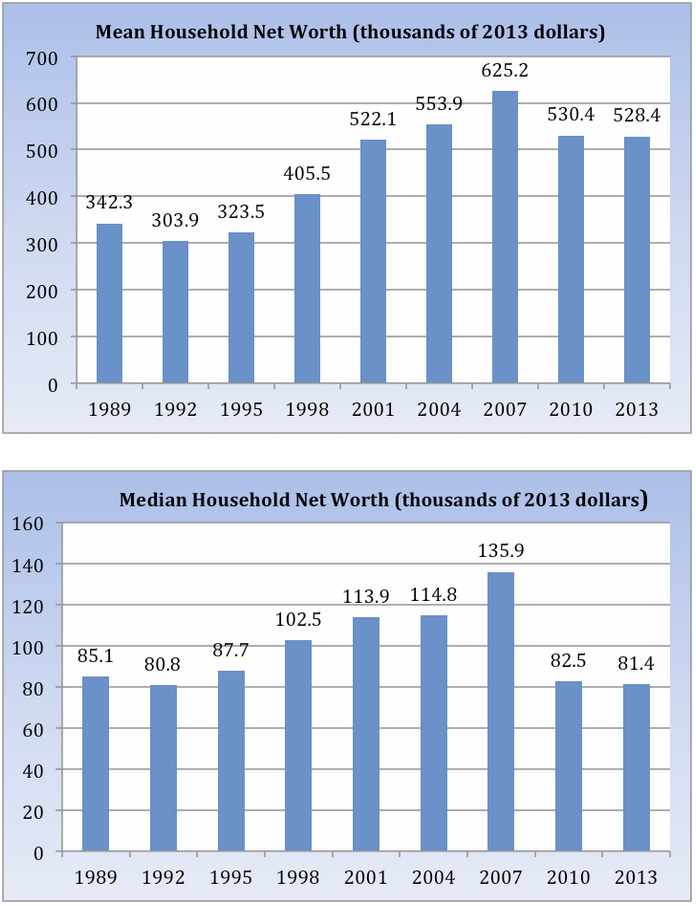

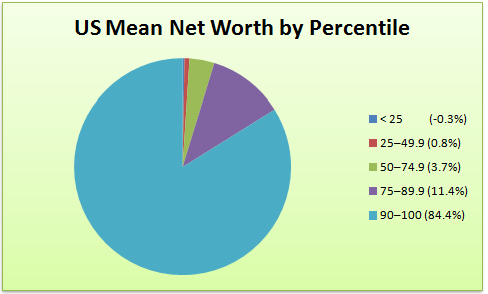

What really caught my attention was how skewed the distribution of wealth is with the mean (aka the ‘average’) being 6.5X the median* (50% above, 50% below). How do we keep the peasants from revolting in these conditions? Or more realistically because 90% of us are not in the top 10% why do we not revolt?

This means that the economy is suffering from the Nick Hanauer problem; the wealthy aren’t buying consumer goods in proportion to their wealth. The odd collector aside how many pairs of shoes or pants does anyone buy? (http://www.politico.com/magazine/story/2014/06/the-pitchforks-are-coming-for-us-plutocrats-108014.html or if you prefer video: https://www.ted.com/talks/nick_hanauer_beware_fellow_plutocrats_the_pitchforks_are_coming?language=en )

Since 70% of our economy is generated by consumer purchases, if the economy isn’t growing it’s because the 1% (top 10% actually) aren’t pulling their weight. On average they should be buying 6 – 1/2 times as many shoes, pants, happy meals, TVs, etc. as the average person. And buying a car that’s 6.5x more expensive than average doesn’t help much because the multiplier effects depend as much on the volume of goods as the amount of dollars spent on them.

The same effect is slowing down housing, the sector which traditionally helps pull the economy out of recession. “As of 2012, the top 10 percent of U.S. housing stock held 52 percent of aggregate housing value, worth nearly $4.4 trillion . . . Contrast this with the bottom 40 percent, which accounted for just 8 percent of the housing value of all 2,200 communities.” (See 2000 Cities Report)

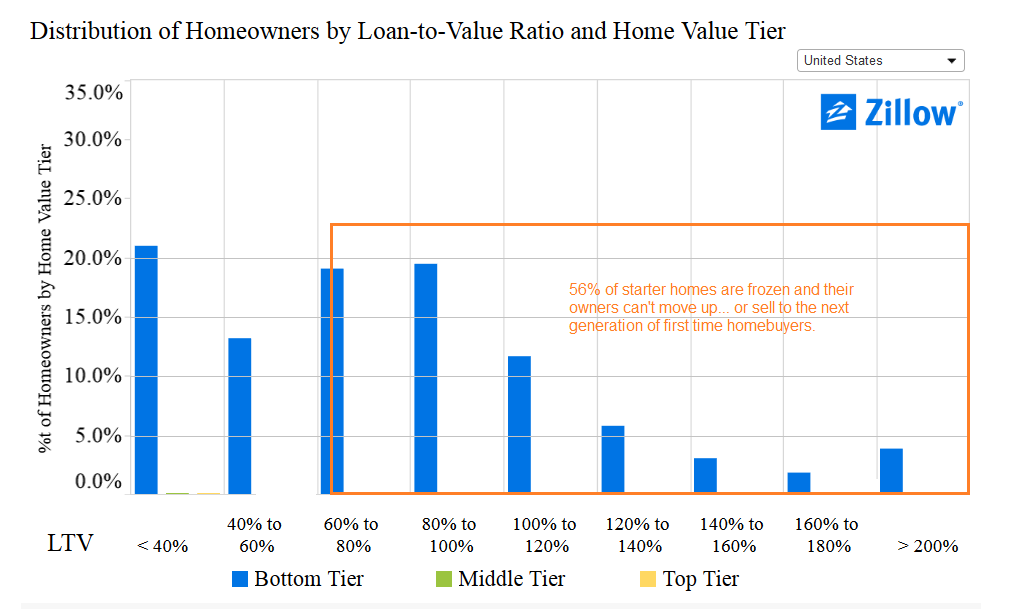

Data from earlier this year shows that 56% of starter homeowners with a mortgage are frozen in their homes and can’t net enough from selling to repay the mortgage, pay the costs of selling the home and have enough left over to make the 20% downpayment on another home of the same price, let alone move up. This of course means that those who would be in the next wave of starter home buyers have very little inventory to choose from. High end builders are busy but the starter and move-up builders are building apartments (See: Home Builders Turn to Rental Apartments)

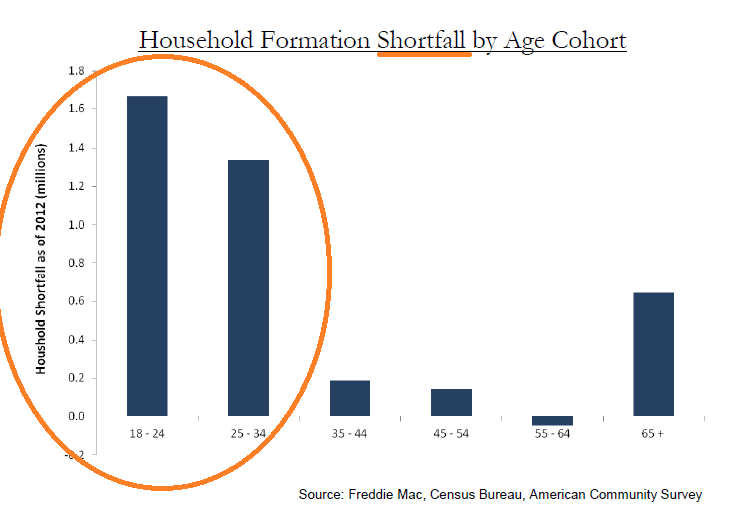

Our most realistic hope of generating a stronger recovery lies in the fact that Demographics is Destiny. Eventually and hopefully sooner than later the millennials will start having babies because nothing helps an economy as much as a growing population. Or alternatively we could implement a more rational immigration policy but I give that a snowball’s chance in congress of happening.

*Quick refresher for those whose statistics class was first thing Monday morning: A statistic or distribution is ‘skewed’ if there’s a large difference between the average (mean) and the median. This is caused by a few really high or really low data points that pull the average away from the median which is the centerline of the data set; if the mean is higher than the median there’s a few really big numbers in there and vice versa if the mean is lower than the median.

Great explanation. I hate to think we’re counting on the Millennials to bring us out of this one. Haa! Just kidding…but not really.