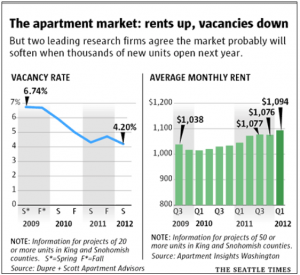

When it comes to apartment building investing one has to consider homeownership as competition for ‘our’ residents. But now in a post that’s part of his series on where the housing market stands today, Barry Ritholtz over at The Big Picture blog has this to say:

“There are many good reasons to believe that the 5.5 million foreclosures we have so far brings us only to the 5th inning of this real estate cycle. We are, in my best guess, barely halfway through the full course of foreclosures. By the time this entire unwind is complete, the United States may end up with a total of 8-10 million foreclosures.

Therein lay the Psychology factor. Once we begin to see an increase in foreclosures, the data is going to be far less accommodating. Monthly prices start falling, fear levels rise, and a viscous cycle could begin. Consider the recent college grads, who typically form each wave of first time buyers. From their perspectives, this whole housing thing must seem absurd. Their observations about home ownership is not the American Dream, but rather, a nightmare. Yale professor Robert Shiller worries that we have lost an entire generation of potential home buyers.” [Emphasis mine] BTW, Shiller is co-author of the Case-Shiller index, a measure of the state of the housing market. Continue reading Attention apartment investors: An entire generation has lost its interest in homeownership.