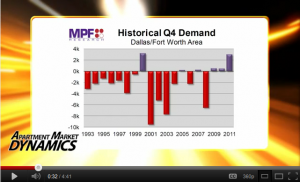

Year-over-year rent growth reached a two-decade high in the Dallas/Fort Worth apartment market. And demand in 4th quarter — typically a slow leasing period — was unusually strong.Record Multifamily Rent Growth in DFW

Tag: apartment demand

Only 38k Multifamily units added in 2011; demand = 300k+. Grubb & Ellis 2012 Forecast

New development is picking up but is restrained by lack of lender appetite.

Senior housing to see vacancy decline below 10% also.

Via Grubb & Ellis’ 2012 Real Estate Forecast available here: http://bit.ly/xfBnmd

Thanks to Jason Brumm of G&E San Antonio

The Apartment Building Investment Triple Opportunity Is Right Now

For value investors, Demand, Supply and the Cost of Acquisition are the three factors affecting the apartment building investment decision and all are saying the time to buy is now. There is a tidal wave of new renters coming into the market and there has been little apartment construction to meet this growing demand. Outside of the gateway cities the prices of existing apartment buildings remain below the cost of building new. Fixed rate financing is available for apartment buildings at rates lower than we will see again for years if not decades.

“The multifamily sector is probably the only commercial real estate sector that has very positive fundamentals behind it,” said Jeffrey Baker, managing director at Savills LLC, a real estate investment bank that raises capital for multifamily owners and developers. “You’ve got a demographic that is producing more households that want to rent an apartment. You’ve got virtually no new supply that’s been added over the last several years.”1 Continue reading The Apartment Building Investment Triple Opportunity Is Right Now

Top Ten Reasons To Own Apartments Now

I believe that apartment building investment should be a core holding for every successful conservative investor. Briefly here are the top ten reasons for low risk investors:

1. Monthly Income. Properly acquired apartments generate monthly checks in 6-8% or higher annual cash on cash returns.

2. Straight forward, conservative investment strategy. Buying existing apartment buildings with good due diligence means that you know what you’re getting going into the investment. Apartments are not subject to sudden changes in investor sentiment and/or valuations.

3. The numbers determine the value. Apartments are valued based on rents less expenses (Net Operating Income) and increases in rents can go straight to the bottom line increasing the value.

4. Inflation protection. Rents rise with inflation and with 12 month leases every year there is the opportunity to adjust rates. With fixed rate financing your income goes up while your biggest cost stays the same. Continue reading Top Ten Reasons To Own Apartments Now

More Positive Indications for Multifamily

At the end of last year (See my Dec. 28 post Why buy Multifamily in ’09) I laid out a number of factors pointing to the opportunity to secure good returns on income producing apartments this year. As time marches on we are receiving more corroborating evidence of a market bottom for multifamily at the same time as the credit market for these properties still has money available for acquisitions.

From a diverse range of reports starting with the ULI/PricewaterhouseCooper’s Emerging Trends in Real Estate 2009, Real Capital’s report published mid-Feb to Marcus & Millichap’s conference call last week (Feb. 24th) we are seeing a real buyers market develop in multifamily.

First of all multifamily starts are projected to be down at least 30% this year on top of being down 50% in ’08, meaning starts are down 85% from two years ago. Balanced against this lack of supply is the fact that Census Bureau projections show the growth in the prime renter segment of the population (20-34 year olds)will accelerate significantly over the next five years forcing rents higher over that period. There will also be a steady if not growing stream of immigrants who tend to long term renters. Continue reading More Positive Indications for Multifamily

Why buy Multifamily in ’09?

As I sit here looking out at the snow while I’m taking time to review and update my goals for the year there are stars aligning to make the new year a positive one. Especially if you are looking for alternatives for your investment and retirement money. The stock market hasn’t been good to us (I look at my account statement from between my fingers!) and the prognosis for the next year or two isn’t much better.

In contrast there are a number of reasons to consider owning multifamily properties, specifically apartment complexes with more than 100 units. Before I go into the reasons why now is a good time let me first be clear about what I’m NOT recommending, the landlording business. The reason to focus on properties with more than 100 units is that they are large enough to support both professional management and professional maintenance; most likely having both onsite full time if not living there. As an owner of this type of property your job is to review the management reports and manage the managers, not unclog toilets or take phone calls from tenants. Continue reading Why buy Multifamily in ’09?