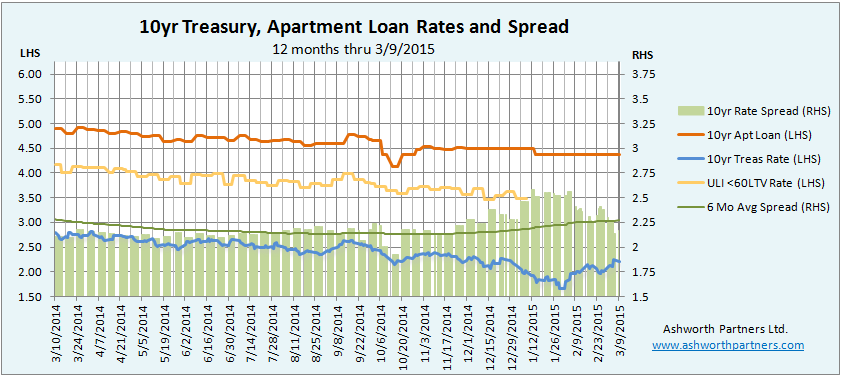

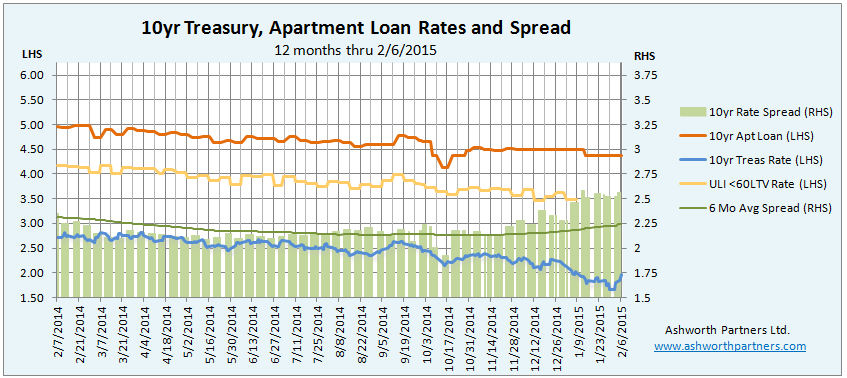

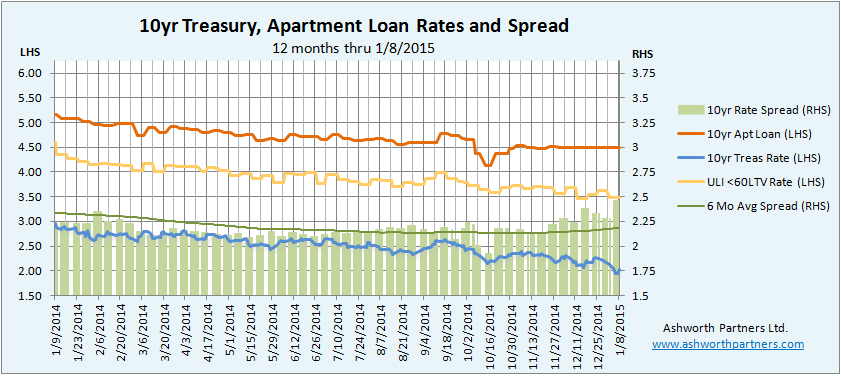

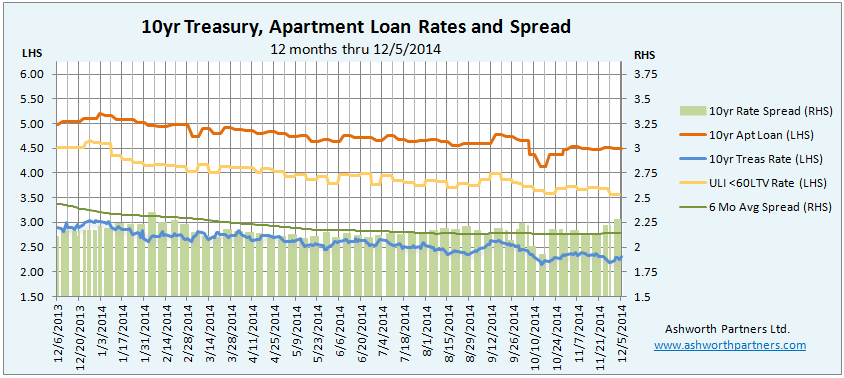

The apartment building investment loan rate we track remains at 4.375% where it landed back in the middle of January. Other than a brief one-week visit to 3.396% back in March which wasn’t even enough to move the chart line it’s been steady as she goes:

With the 10year Treasury dipping below 2% the spread has been widening as 4.375% seems to be the new 4.5%. Once again people are expecting rates to go up later in the year (is this the third or fourth year for that prediction?) but the Fed and the Government have been following the Japanese model step for step and their Ushinawareta Jūnen (Lost Decade) is old enough to drink and will be graduating college soon. I’m not sure why anyone thinks this time will be different just because we’re talking dollars instead of Yen. But there is this:

That men do not learn very much from the lessons of history is the most important of all lessons that history has to teach. – Aldous Huxley

In other news Susan Persin, Senior Director of Research at Trepp has Continue reading Apartment Building Investment Loan Rate Continues Its Steady State