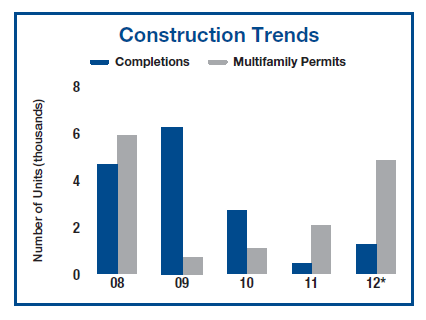

Successful apartment building investing is about knowing where and when to buy and when to sell. The apartment building investment cycle sends very clear signals to those paying attention and one of the biggest and clearest is when existing properties begin to sell for more than the cost of building new apartments. As I mentioned here this line was crossed about a year ago in the Seattle market and now we can see how the peak is formed, when every developer and their brother starts building new apartments.

From Bloomberg:

The biggest surge of Seattle-area apartment construction in a quarter century is threatening to undercut the growth in rents. Seattle went from “dead last” in rent increases three years ago to 13th out of 88 markets last year. “We went from almost a desert to a big pipeline” in two years, said David Young, the Seattle-based managing director who oversees western U.S. apartments for commercial broker Jones Lang LaSalle Inc.

Encouraged by hiring at local employers such as Amazon.com, Boeing and Nordstrom, developers are building almost 10,000 apartments in Washington state’s King and Snohomish counties, Three- quarters of the total are in Seattle, with 4,619 of those units in or near downtown.

Dupre + Scott Apartment Advisors Inc. said the building boom may last through 2016.

“If in fact we come to market when there’s excess supply, we’ll just have to be aggressive on rents,” said Continue reading Now you can watch the Apartment Building Investing Cycle Unfold In Real Time- Much easier than deciphering technical stock charts!