How do apartment building residents actually want to live? Do they want sidewalks in front of their apartments and actual places to walk to—“Leave the car in the garage!” is a common refrain on real estate sites—or are Americans happy, as transportation analyst Alan Pisarski puts it, to “drive to where they can walk?” The truth is there are relatively few places in America that today would pass what architect Hal Box has dubbed the “Popsicle Rule”—“a child must be able to walk safely from home to buy a Popsicle within five minutes.”

How ‘walkable’ is your property? Your next apartment building investment? How do you figure that out?

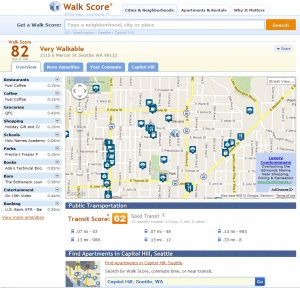

Walk Score is a website that takes a physical address—enter yours here—and computes, using proprietary algorithms and various data streams, a measure of its walkability. More recently it’s started tracking how transit-friendly neighborhoods are too. What drives the score is choice and proximity—the more amenities (restaurants, movie theaters, schools) you have around you, and the closer they are, the higher your Walk Score.

“In most metropolitan areas, only 5 to 10 percent of the housing stock is located Continue reading Do you know the Walk Score for your Multifamily property? Should you check before your next acquisition?