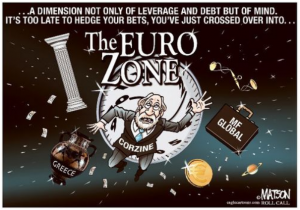

Elected attorney general in November 2010, Schneiderman discovered upon taking office that the Obama administration was avidly promoting a proposed settlement among five mega-lenders… In return.. the feds and the state AGs would grant the banks immunity for not just any further robo-signing misdeeds but for all illegal conduct that had led to the 2008 collapse… the banks would be free and clear of any state or federal prosecution for these offenses. Indeed, with no agency of government able to bring legal action, there would be no serious investigation of whether and how the banks broke the law.

“We have to get accountability,” Schneiderman told me this week. “We have to get substantial relief for homeowners and investors. And we have to get the story told clearly and factually, so the history doesn’t get rewritten. If you listen to the presidential debates, you hear the same supply-side and deregulatory nonsense that got us into this crisis. If we don’t uncover the facts and put them out there, it will happen again.”

See the whole article here: The man who shaped Obama’s drive to hold banks accountable