Bill ‘The Bond King’ Gross, founder of PIMCO says that the long run of stocks outperforming the overall economy is done and that the only policy option left for the ‘advanced’ economies in the world is inflating their way out of debt. Since Inflation = Higher Interest Rates and rising rates reduces the value of existing bonds issued at lower (currently near zero) rates, they don’t look to good as a long term investment either. See his letter here PIMCO Investment Outlook

So what’s a saver or investor to do, especially those nearing or at retirement? Chase yields in emerging market bonds? Who would you trust for information about those issues? Have those economies really decoupled from the US and Europe? Where could you find a decent stream of income with inflation protection build in and appreciation potential on top of that?

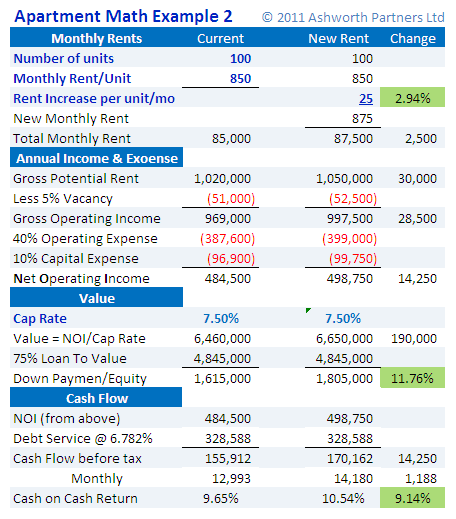

Apartment building investments. As we’ve laid out previously apartment owners can benefit from even small increases in rents, have demographics and social trends on their side and new supply has been quite limited over the last decade (see here, here and here for the details). Does the prospect of high single digit current income with inflation protection and even appreciation potential warm your retirement spreadsheet?

In this example, raising rents $25 or about 3% increases the value and owner’s equity $190,000 or almost 12% plus the income goes up more than 9%. That is the power of apartment building investment. Notice that in this example that the building is nearly full, if we were to buy a building that had more vacancies we could have paid a lower price based on the lower Net Operating Income and we would have the opportunity to create even more value by improving the management to bring in more renters. That is why we like apartments.

When I talk about investing in apartments I am not talking about being in the landlord business, I am talking about being in the property owning business and one of the expenses we gladly pay is for professional property management. We’re not in the tenants, toilets and trash business; we hire the pros to handle that and our job is to manage the managers…. And reap the rewards. Find out how we invest in apartments and how you can too by contacting me at giovanni@ashworthpartners.com.