3-4% 10yr bridge money for apartment building investment and rehab “coming out of the woodwork”. See the whole article here: Capital Streams Grow for Rehab

Tag: Apartment building investment

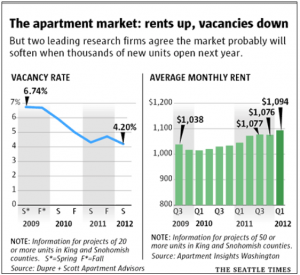

Seattle Multifamily Vacancy at 4.2% Says Dupre + Scott, average rents over $1,500 too.

For more on the Seattle area apartment building investment climate see the Seattle Times article here: Apartment rents likely to keep rising through 2012

Hat tip: Paul McFadden

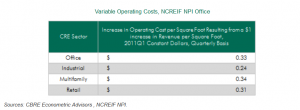

What drives changes in operating expenses (OPEX) for CRE and Multifamily? Nice research from CBRE Econometric Advisors

As every landlord knows, operating expenses (OPEX) are an important element of commercial real estate investment performance. In spite of the important role OPEX plays in investment performance, there is very little research that analyzes the structure of these costs or identifies what drives the differences in these costs across markets. This article aims to share the latest findings on the drivers and structure of OPEX.

… That industrial variable costs have a lower elasticity than those of the other property types accords with what investors in this asset class generally experience: that these properties are usually cheaper to operate. A perhaps more surprising finding is that the elasticity coefficients for office, multifamily, and retail—property types with significantly different operating structures—are fairly similar to one another. We are conducting further research to better understand this finding.

See the whole piece here: What Drives Operating Costs in Commercial Real Estate?

Getting Inside the Head of Today’s Online Renter, multifamily report now available.

From my friend Heather over at Behind The Leasing Desk Consulting: “fact: I ♥ Satisfacts! Check out their new report on the mind of the online renter for some great insight into what your potential residents are thinking.”

From my friend Heather over at Behind The Leasing Desk Consulting: “fact: I ♥ Satisfacts! Check out their new report on the mind of the online renter for some great insight into what your potential residents are thinking.”

From Satisfacts: “We asked, and now it’s ready for YOU. Getting Inside the Head of Today’s Online Renter is the most comprehensive analysis ever conducted in the industry on the impact of technology and social media on apartment marketing and operations.” Get the report here

30 story building built in 15 days- amazing video. 5x more energy efficient…

Multifamily is best Commercial RE sector but…. Video from Starpoint CEO Paul Daneshrad

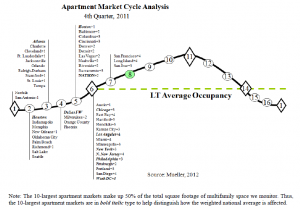

Where is your apartment market in the cycle? Latest Multifamily Market Cycle Charts now posted via Glenn Mueller, PhD.

Canadian office, industrial and retail Real Etate on fire too. Not just multifamily.

see the CNW article here: Strong performance in Canadian real estate continues

FHA Makes Strides on Speeding Up Its Multifamily Tax Credit Loan Process.

[The FHA] is ushering in the long-awaited Tax Credit Pilot Program, mandated by the 2008 Housing and Economic Recovery Act.

The pilot program aims to drastically speed up the processing time of FHA-backed deals that use low-income housing tax credits (LIHTCs). In the past, LIHTC developers had difficulty using the FHA—the LIHTC program carries strict deadlines, and affordable housing owners and developers just couldn’t wait around for the FHA’s notoriously slow turnaround times.

This new program aims to fix all that. “Expediting our delivery system is a big agenda for us,” says Head. “And it’s one of my biggest priorities.” See the whole MFE Mag article here: FHA Makes Strides on Speeding Up Its Tax Credit Process

When long time contrarians flip is that confirmation of a market top? What about in multifamily?

Read this week that well known stock market perma-bears have gone bullish and that struck a nerve in my contrarian’s contrarian heart. This morning I read a post on the Joseph Bernard Investment Real Estate blog that really got my attention. Here’s what stopped me in my tracks:

In three decades working in and studying multifamily, Johnsey, president of Dallas-based research firm Axiometrics, has developed a bias toward an outlier’s view of what’s happening and what’s coming next. This time, though, it’s different. Strangely, he’s finding no counterpoint position to argue.

“Everything is just ripe for a robust apartment market,” Johnsey says. “I’m always looking for problems. But these numbers are just some of the strongest I’ve seen.”

Johnsey has company aplenty. Market researchers, Wall Street analysts, REIT executives, big multifamily players, and small alike can scarcely quell optimism over practically a sure bet for a bountiful 2012. [Emphasis mine]

Regular readers and students of the financial collapse will instantly recognize the first highlight as echoing the title of probably the best book ever written on the subject, “This Time Is Different: Eight Centuries of Financial Folly”. Authors Rogoff and Reinhart have researched and written (exhaustively) about how many times that sentiment has proven exactly wrong. If you haven’t read it, check it out on Amazon by clicking on the book image in the ‘Learning From History’ section on the right of this page.

Granted the rest of the article goes on to lay out the great fundamentals the national apartment market is currently enjoying and further that short of institutional grade properties in core markets multifamily is a very local business (and properties are more reasonably priced). But still…

What are you seeing in your market?