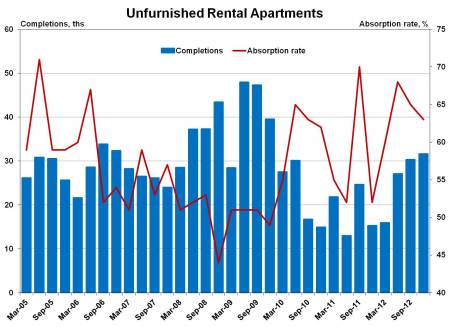

The NAHB (National Association of Home Builders) Eye on Housing out late last week included a chart of 5+ unit apartment building construction and absorption in the US. Built with the latest data from the Census Bureau’s SOMA (Survey of Market Absorption of Apartments, xls available here) is shows that absorption is holding in around 65% even while construction of new units is picking up:

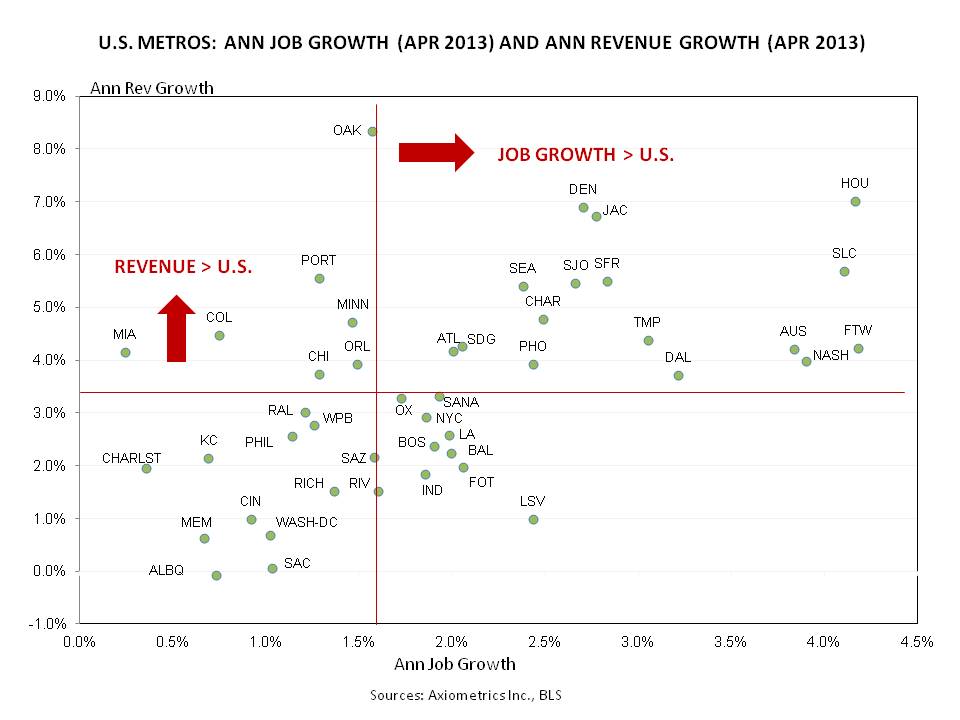

The job growth isn’t distributed evenly across the US however. In the chart below from Axiometrics’ latest Jobs Report we can see which metros areoutperforming the national average for job and revenue growth:

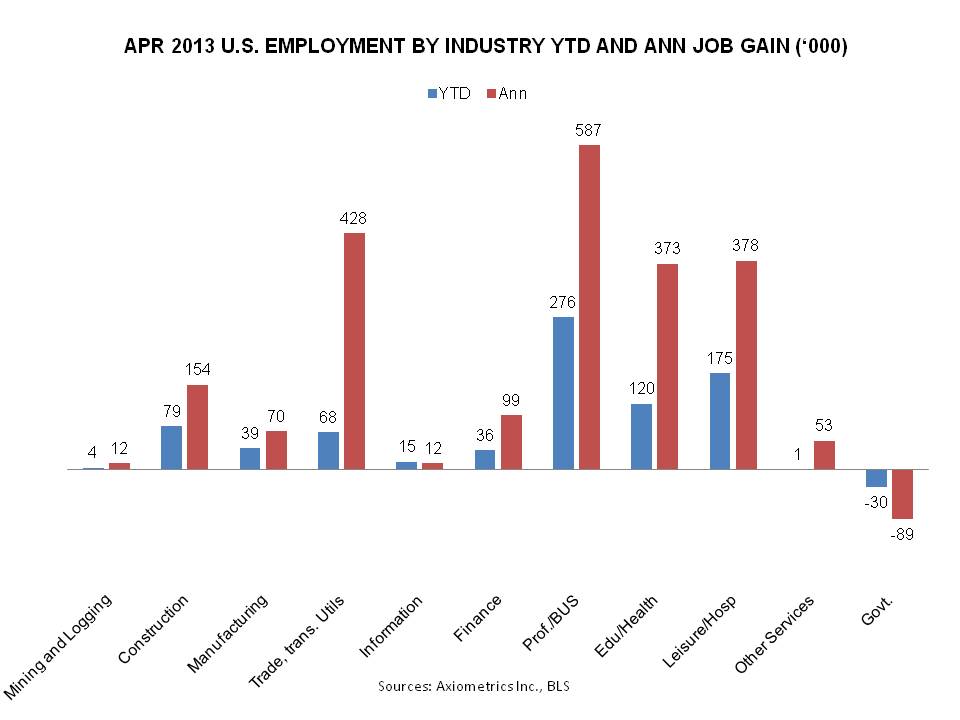

And from the same report we can see which industries are enjoying the largest portions of the job growth:

It looks like class B apartment building investments would be favored because of the growth in Trade, Transportation Utility; Education, Health; Leisure, Hospitality sectors. If investors can locate these type properties in the markets shown in the upper right-hand quadrant of Metro chart above they will be well positioned. If you would like to locate a good apartment building investment in the western US we can help.