Just after I hit Publish on the top markets for population and job growth piece called: Skate to where the apartment building investment puck is going I found a great Richard Florida Atlantic piece for this month’s edition called The Boom Towns and Ghost Towns of the New Economy looking into the changes of fortune for US markets since the crash five years ago.

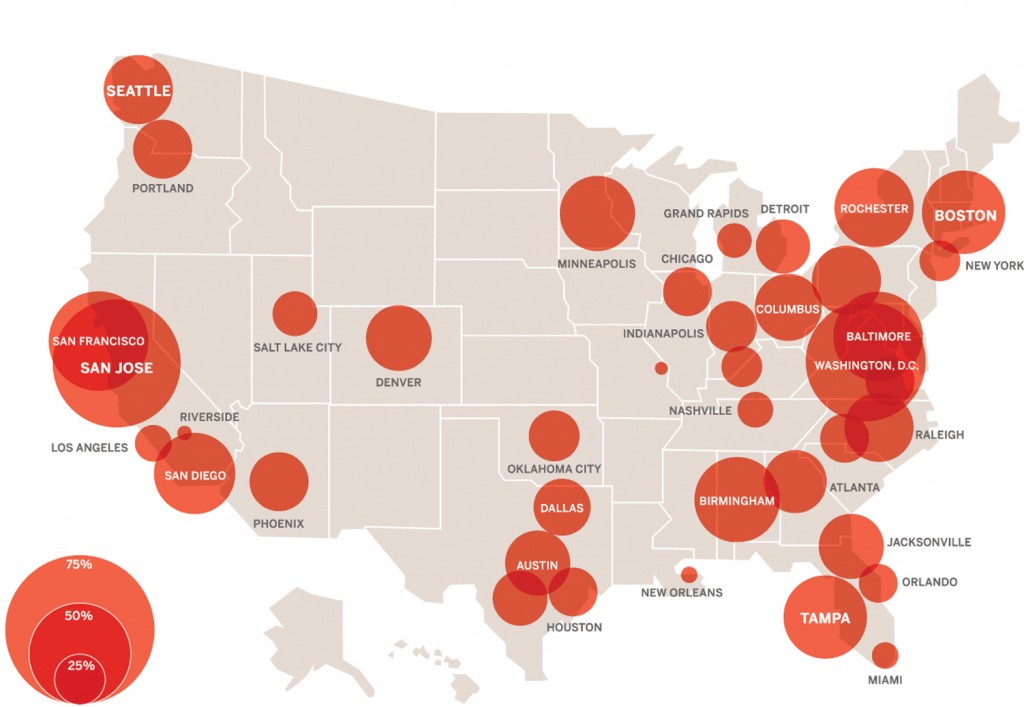

The recovery has been good (What crash? good in a few) in some areas, seemingly non-existent in others and in many a slow grinding process that has yet been unable to return to pre-crash levels. The first thing that everyone should look at is job growth but Florida looked deeper into High Wage growth around the country:

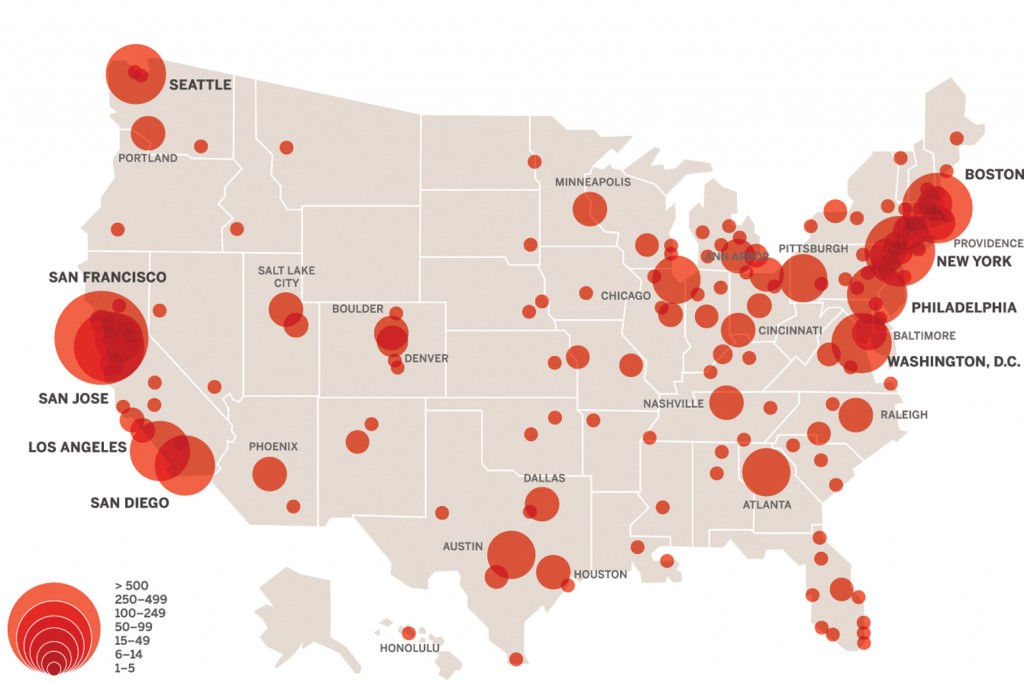

And then looking forward into the future he looked at where venture capital investments were made last year to see where high wage growth may be coming:

All the usual suspects show up on the venture capital map but in addition there are a few like Salt Lake City and Nashville that I hadn’t really looked at before. Some of the high wage stars are new to me as well, such as Tampa, Birmingham and Minneapolis. So now there are an armful of new markets to research from these four maps and I’ll be digging in soon. Is there a new market you think might be worth investigating?