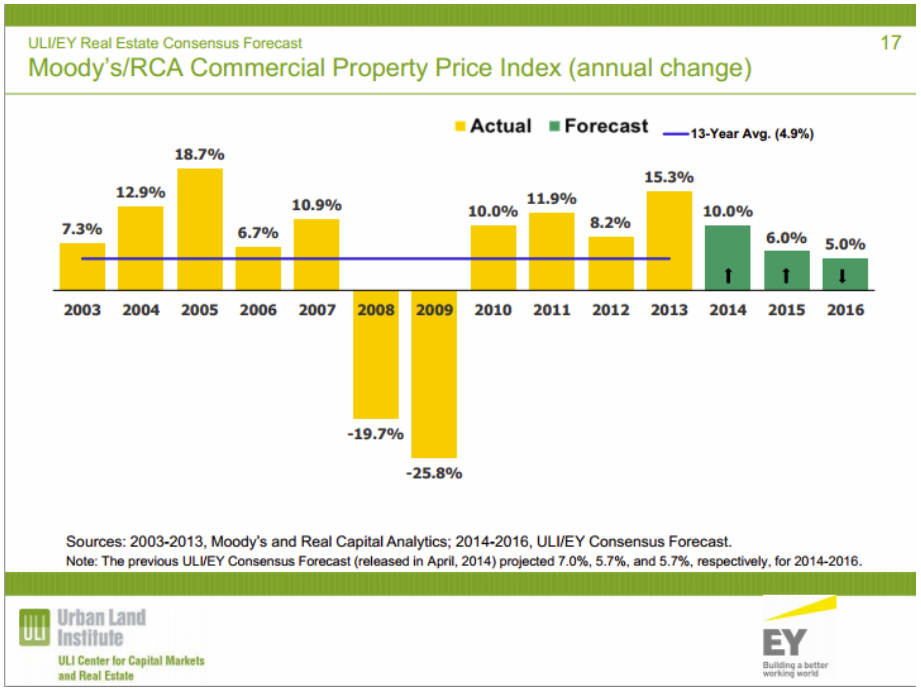

The latest ULI/EY (Urban Land Institute/Ernst & Young) Commercial and Apartment forecast shows that respondents expect price growth to slow during the next three years but they expect better growth than when queried in April this year:

Back in Q2 the economists and real estate pros thought prices would appreciate 7% this year and 5.7% in both 2015 and 2016. Now they expect 10% growth this year and 5.7% next year falling to 5% the year after. These kinds of surveys and charts usually set off all kinds of behavioral economics warning bells in my head but I’ll let you be the judge… The web piece is here, the full report here.

That said, this chart probably is the clearest depiction of how the statistician drowned in water that averaged only three feet deep. What happened to those deals underwritten with the average growth number when 2008 and 2009 came along? To avoid this fate I highly recommend reading Sam Savage’s The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty (http://amzn.to/PKIaOc on Amazon)