After a recent speaking engagement I was asked about how and why I use the earnings multiple concept when evaluating apartment investments. It was a great question and so I’m sharing my answer here in this blog post.

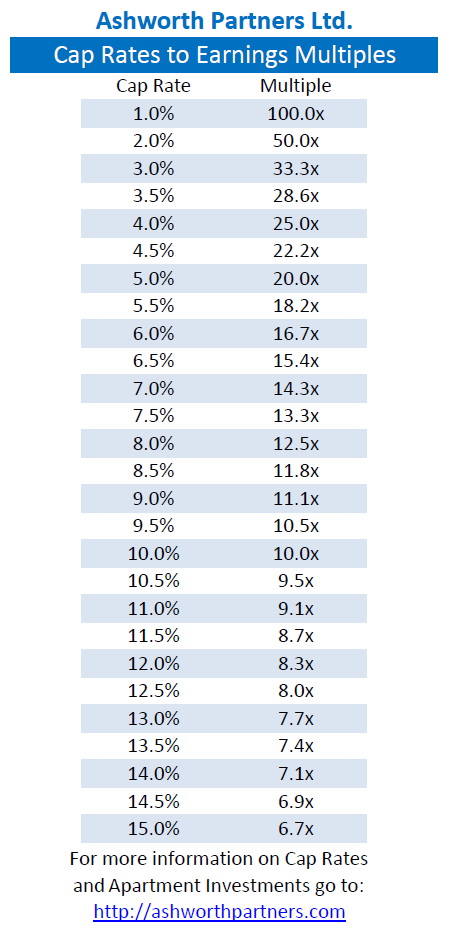

As a value investor two of the fundamental questions I always ask is what am I buying and how much do I have to pay for it. With an apartment investment (or really any investment) I am buying current income and the potential for appreciation so the second question comes down to “How many years of earnings do I have to pay for these returns?” The question can be answered by converting the cap rate to an earnings multiple. The Cap Rate is the return in current income on an apartment investment you could expect if you paid all cash. To convert a Cap Rate into a Earnings Multiple use the formula:

1/ Cap Rate% = Earnings Multiple

For example a 6% cap rate is equal to almost 17x Net Operating Income whereas a 8.5% cap is just under 12x. That means if I bought a property for all cash at a 8.5 cap and rents remained the same it would take about twelve years to get my money back. At a six cap it would take about seventeen years which seems like a very long time. Granted that we typically buy apartments with a loan that increases our potential return and we try to buy properties that have identifiable opportunities to increase rents but the earnings multiple is a very good barometer of the risk in the investment. Especially these days when Cap Rates in certain markets are getting down into the 5s and 4s (20-25 years of earnings) I’ve attached a chart of Cap Rates to Earnings Multiples for your reference.

The earnings multiple is a tool most stock market investors use and I think it applies equally well to apartment building investments. Try this out on the next deal you look at and let me know what you think- Giovanni

Hi there,

Is there a direct relationship between cap rate and earnings multiple? Looking for a quick rule of thumb to convert a cap rate to an earnings multiple. They are not linear so maybe not.

Hi Adam,

First thanks for your interest in a six year old post.

To answer your question, yes there is a direct relationship between cap rate and earnings multiple… but it’s not a one-to-one relationship (math can be like that sometimes). So depending on how much math you can do in your head (https://www.ted.com/talks/arthur_benjamin_does_mathemagic) you can either use the formula (which is shown after the second paragraph in the piece) or you can just look at the chart after the third paragraph. Sometimes the rule of thumb is ‘do the math’ which is why I built the table to make it easy.

Good hunting-

Apple common stock (AAPL) traded at around 15.5x earnings yesterday. If Apple was an apartment building its Cap Rate would be 6.5%.

BTW a Cap Rate on an Apartment Building is the same as the Earnings Yield on a stock.