Update 2:51pm Wednesday Oct. 15- updated to reflect that the 10yr apartment loan rate was lowered on Oct 1st but the spread was higher.

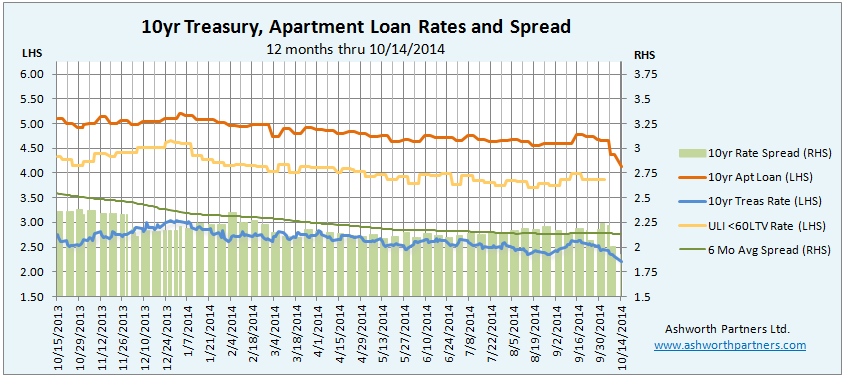

Well apartment building investors, things just keep getting interestinger and interestinger as a friend used to say. Just last month I was asking if 4.5% was the lower limit on the 10 year loan we track and sure enough a few weeks later it plunged through that to come in at 4.139 Monday after a brief stop at 4.365 last week. Note that both the 10yr Treasury (or T10, which drives these types of rates) and the spread between the T10 and the apartment rate fell with the spread dipping below 2%, coming this week at 1.929%:

The spread has been jumping up and down quite a bit as you can see, I think because initially the bank was going to try and hold the 4.5% minimum rate and they let the spread go out to 2.25 as the T10 continued to fall from the middle of September. Note also that this volatility came with a couple mid-week rate changes, the first on Oct. 1 when they lowered rates (but raised their spread) and then on Oct. 7 when they reduced their spread by more than 20bp into a falling T10, dropping their rate announced the previous day by almost 30bp.

Meanwhile the ULI <60% LTV rate loan has flatlined at 3.86% though their last update was on Sept 29th (reporting rates as of the 19th) when they said: “If you are waiting for someone to ring a bell and say that we have reached the bottom, consider the bell rung. Think twice about ignoring these record-low levels.” Monday’s Numbers: September 29, 2014 [Emphasis mine]. Notice the T10 has continued lower since then and as I have written about previously (see here and here), just because everyone knows that rates have to be going up doesn’t make it so.

One thing to consider is that while we’re almost hard wired to believe that rates must be going up at some point, we could actually be turning Japanese with the Fed caught in a liquidity trap that keeps rates chained near the zero lower bound for an extended period. Japan’s Ushinawareta Junen (Lost Decade) is getting to be twenty five and some observers believe the US has been heading the same direction since the turn of the century.

Since the dot com implosion in 2000 easing ahead of the Y2K ‘bug’ every time the Fed has tried to tighten it has caused a recession and they’ve been forced to backtrack. But if you are like me you’ve grown up in a time when inflation was the big concern. I (and maybe you too) have a hair trigger sensitivity to anything that smells like inflation but the real fight seems to be against deflation. If Ben/Janet’s secret battle has been fighting off deflation (which is what made the Depression so depressing) then turn everything you’ve learned since the 1940’s on its head. For a great explanation of how deflation works see Ray Dalio’s video; How The Economic Machine Works.

Maybe the Fed has beaten deflation here in the US but the rest of the world not so much as Europe including now even Germany has stalled, China is trying to engineer a soft landing for their economy while containing protests (and aspirations) in Hong Kong and Japan, well Japan’s Lost Decade is old enough to drink and should have graduated college by now. This means that while the US economy may not be grabbing a higher gear right now by comparison it’s doing much better than everyone else’s making Treasuries the least dirty shirt in the laundry. Combine that with an appreciating US dollar and we will have foreigners bidding up Treasuries which forces rates down-

One other item to file under interestinger is that the bank whose 10yr apartment loan (see below for details) we track also offers a 15yr loan with very similar terms but the rate on it has been lower than their 10yr for the last month or so. This would imply a negatively sloped yield curve (or contango in trader speak) which normally is a sign of an economic slowdown in the offing but may be instead that the 15yr is where they want to win a bunch of business. By the middle of next month we’ll have a year’s worth of rates for the 15yr loan and it will be added to our rate chart in December.

About the spread between the T10 and the apartment building rate we track, the green line on the chart represents the six months trailing average spread. We track changes in the trend for signs apartment lenders becoming more or less competitive. Note that since rates are only quoted on business days the chart averages the last 120 business days which equates to roughly six calendar months.

We track the 10 year Treasury (T10) because that is the benchmark most lenders base their long term rates on. In order to lure investors away from Treasuries to buy mortgage bonds lenders have to offer a premium (AKA ‘spread’) over what can be earned on the Treasury. So when the T10 moves, rates on all kinds of longer term loans including on apartments tend to move also. As you can see in the chart, the spread also widens and narrows as market forces make an impact.

Notes about the apartment loan rates shown in the chart above: The rates shown here are from one West Coast regional lender for loans on existing apartment buildings between $2.5 – 5.0M. The rate quote they send every Monday that I track is a 30 year amortizing loan with a fixed rate for 10 years (They also have other fixed periods at different rates). The max LTV for this loan is 75% (they have an even lower rate on their max 60LTV loans) and the minimum Debt Cover Ratio (DCR, aka DSR or DSCR) is 120. Note too that these are ‘sticker’ rates, LTVs and DCRs and ‘your millage may vary’ depending on how their underwriting develops. I usually figure that we’ll end up at a 70LTV which also helps the debt cover and provides a larger margin of safety, which is half the battle from a value investing standpoint.

The prepay fee is 5,4,3,2,1% for early repayment in the first five years and you do have the ability to get a 90 day rate lock. The minimum loan is $500k (at a slightly higher rate for less than $1M loans) and they’re pretty good to work with as long as you go in knowing that it takes up to 60 days to close their loan. If you are looking at acquiring an apartment building in California, Oregon or Washington I’d be happy to recommend you to my guy there for a quote. Send me a message through this link and I’ll make an introduction for you.

The other rate we track is the from the Trepp survey which the ULI (Urban Land Institute) reports on. According to the ULI the Trepp rate is what large institutional borrowers could expect to pay on a 10 year fixed rate, less than 60% LTV loan for a “crème de la crème” core property located in a gateway market. We track this rate as a barometer of what the largest lenders are offering their best customers on the most secure loans for any advanced warning about future rate and spread changes. Note that the spread we chart is between 10yr loan we track and the T10.

How the St. Louis Fed calculates the 10 year Treasury rate displayed above: “Treasury Yield Curve Rates. These rates are commonly referred to as “Constant Maturity Treasury” rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of quotations obtained by the Federal Reserve Bank of New York. The yield values are read from the yield curve at fixed maturities, currently 1, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity. For even more detail see: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/yieldmethod.aspx

As a reminder, one basis point or 1bp is equal to one-one hundredth of one percent or .0001. When you hear ‘fifty basis points’ that’s one-half of one percent; ‘125bp’ would be 1.25% or a percent and a quarter, sometimes referred to as ‘a point and a quarter’. A bp seems like a tiny number, too fine to make a difference but in the debt world if you can squeak out an extra 20bp on a 100 million dollar deal (like a pool of apartment building loans) that’s $200,000.00 in your pocket. To paraphrase Everett Dirksen: “20bp here, 20bp there and pretty soon you’re talking about real money.”