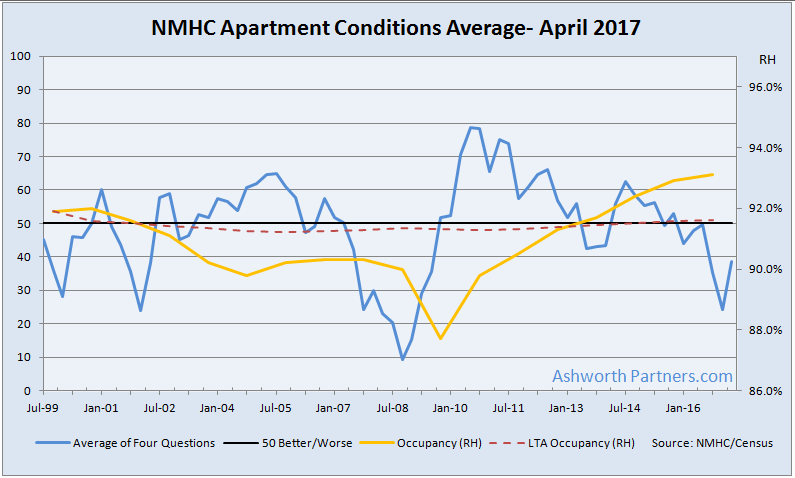

The latest NMHC Quarterly Survey of Apartment Market Conditions average remains in negative territory; marking its third consecutive quarter below 40. The average has now been at or below 50 for a year and a half. Readings below fifty indicate deteriorating conditions.

The four indexes that make up the average each improved over last quarter but all still remain in the low forties or below. Debt Financing rose the most going from 14 to 41*. According to the NMHC: “Forty-four percent of respondents reported no change in the debt market, with 16 percent reporting better conditions, up from only one percent in the previous quarter.”

My take: In many markets class A seems to be at or past the peak in the cycle (with a lot of new supply on the way) but in all of the markets we follow class B and C properties still have very low vacancy. In some of those markets B and C rents are reaching their ‘ceiling’ where tenant’s income won’t support higher monthly rents without doubling up but demand is still strong.

*Random math trivia: If you subtract a number from its reverse, e.g. 14 from 41, the difference is always a product of 9. In the case of 14 and 41 the difference is 27 or 9×3.