Zero interest rates and apartment building investment.

First my condolences to Bill Gross on the loss of his brother-in-law. Reading his piece in PIMCO’s latest Investment Outlook it is clear that the world’s biggest bond manager is running out of places to generate returns for their investors and by extension this applies to all income investors, especially retired people trying to live on interest income. For those would like to retire soon you may have to delay that decision for “an extended period’ as Edward Harrison over at Credit Writedowns put it in Permanent Zero and Personal Interest Income.

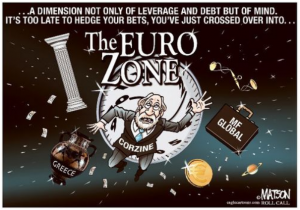

Gross’ points out that the Fed’s zero interest rate policy (ZIRP) which they have just announced to maintain through 2014 and their defacto though opaque continuation of quantitative easing (QE2.5 as he tweeted it) threaten to take us into another dimension where their policies have the opposite effect of their intentions.

“Much like the laws of physics change from the world of Newtonian large objects to the world of quantum Einsteinian dynamics, so too might low interest rates at the zero-bound reorient previously held models that justified the stimulative effects of lower and lower yields on asset prices and the real economy.” – Bill Gross

His bullet points:

- Recent central bank behavior, including that of the U.S. Fed, provides assurances that short and intermediate yields will not change, and therefore bond prices are not likely threatened on the downside.

- Most short to intermediate Treasury yields are dangerously close to the zero-bound which imply limited potential room, if any, for price appreciation.

- We can’t put $100 trillion of credit in a system-wide mattress, but we can move in that direction by delevering and refusing to extend maturities and duration.

For more views on this and Europe too see also Entering the Debt Dimension from Phil’s Picks on the Phil’s Stock World Blog.

What does this mean for Multifamily?

The Zirp Dimension leads to Stagflation where economic growth remains anemic yet prices on essential commodities and hard assets perceived as stores of value continue to go up; Think gold, food stuffs, energy and… income producing apartments(?)

Well maybe not so much price appreciation but a steady source of income and who can say that apartments won’t become more attractive to investors searching for yield? Especially when Bill Gross best idea is 2-1/2% returns on buying agency paper (mortgage backed securities issued by Fannie and Freddie). In the land of the blind the one eyed man is king; if apartments are yielding 2x or 3x agency paper might there be some upside as more investors catch on?

Before that happens I recommend taking advantage of historically low interest rates to secure multifamily properties with conservative leverage and budget that yields 7%+ cash on cash out the door. One whose budget includes professional management so that you are in the apartment owning business instead of the landlording business.

For more information on apartment building investment contact me through: http://ashworthpartners.com/contact/

No wonder apartment buildings are getting so much interest.