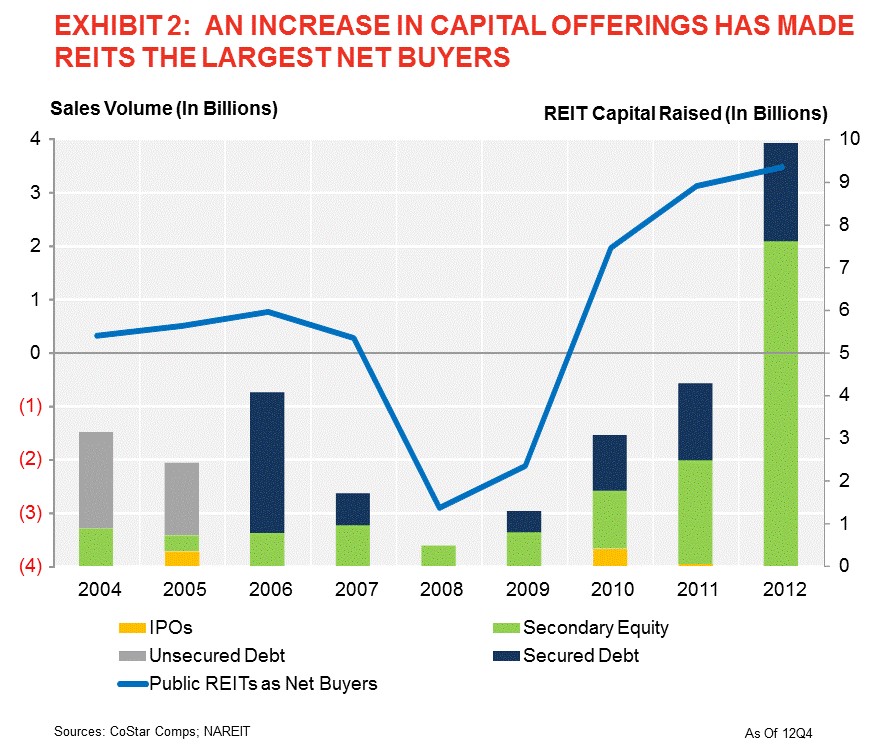

Mark Hickey of CoStar put out a piece looking at who was responsible for the near record $65.8B of apartment building investment in 2012. CoStar’s numbers show that private owners/developers did just about half of all acquisitions last year and institutions were in for 12%, both near their recent trends. REITs on the other hand increased their share by a third, responsible for 12% of sales volume last year.

Interestingly the sellers were pretty much the same groups, except REITs who were the largest net buyers last year.

Last year REITs raised 15x the equity they did in 2008 (and 20x the total capital). Up against pockets that deep you’ll have a hard time outbidding them for a property they want. They’re paying dividends in the threes so they can buy at cap rates in the fours. The resulting cap rate compression is pushing other investors further afield, either into smaller markets, lower class properties or turnaround/repositioning which is causing cap rates to shrink in those sectors also.

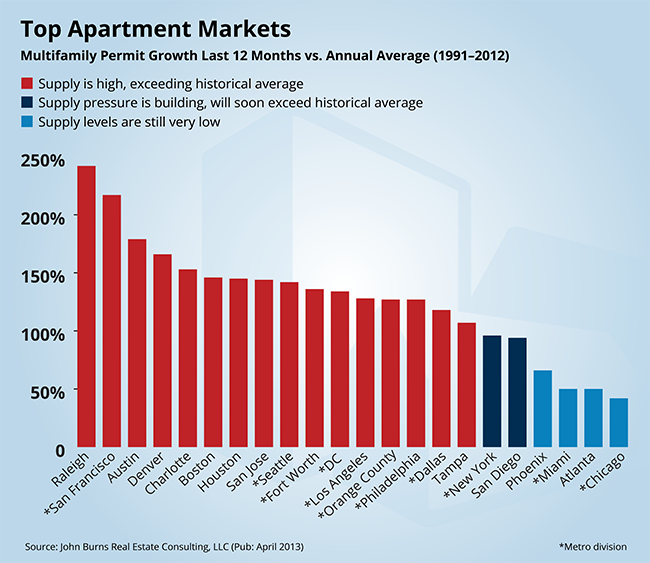

Also because REITs can build to a 6 cap about $3B of their new capital went to development last year. Which has set the over development warning lights off in a number of markets. Real estate consultants John Burns has a piece out with a chart showing that apartment construction is starting to overheat in many markets. The chart shows that permits have risen above their long term average, which goes back to 1991:

Another piece from CoStar looks at office REIT Mack-Cali Realty acquiring apartments instead of office properties. If a mutual fund manager switched from buying value stocks to small cap growth stocks it would be called strategy drift and it’s the same phenomenon with REITs. Chasing the ‘hot’ sector rarely ends well because strategy drift is most likely to happen near market tops as out of favor strategies capitulate and join the trend becoming the final source of new buyers. Granted it’s just one REIT and in truth their NJ office markets sound like they’re hurting pretty bad but… strategy drift is a sign that something is changing.

Strategy drift never ends well.

Finally one other point raised in the first CoStar piece deserves our attention. The article says $3.4B of last year’s total sales were a result of Equity Residential and Avalon Bay buying Archstone from Lehman but the total deal including stock and Archstone’s debt adds up to $16B, making it the second biggest apartment deal of all time…. Second only to when Lehman and Tishman Speyer bought Archstone in the first place! The Lehman/Tishman deal pretty much defined the top of the market in 2007, could the Equity/Avalon deal define another top? Don’t forget that another Sam Zell mega deal defined the top of the office market when he sold Equity Office to Blackstone in 2007 as well.

Now Sam is one of the smartest real estate guys around but he and his ‘buddies’ over at Avalon paid a pretty penny for all those Archstone units and it works only as long as their cost of capital stays low and demand continues strong. Ask the (many now former) owners who bought Equity Office properties from Blackstone what happens to highly leveraged real estate when financing dries up and/or demand falls.

So with Multifamily Executive running articles like “Is Multifamily Heading Toward a Bubble?” it’s a good time to take a look at the apartment building investment cycle to see where we are:

- There is a lot of money chasing deals.

- Plentiful cheap debt is available for deals.

- We’re starting to see strategy drift.

- There are a lot of new units in the pipeline.

- Mega deals are starting to happen again.

- People are starting to ask the ‘B’ word question.

All this seems to indicate that we’re closer a top than a bottom. How close is the hard part because of two factors. The first is that with all the new development we’re only getting back to the long term average of new units needed to accommodate population growth and replace obsolete properties. While true the problem is that many of the starts are happening in a just few markets which means the competition for tenants will be intense (and hard on NOI) when these units come online. So while nationally multifamily is looking OK, in specific markets (where investing actually takes place) some are about to become battlefields for rents, concessions and occupancy.

The second factor is the availability of cheap debt. Having lots of low cost OPM available inevitably leads to market distortions because while you would never do anything too risky with your own money, if the majority of funds comes from someone else it’s easy to reach for the brass ring. It is what’s gotten us into trouble time after time and this time is no different.

The way I see this playing out is that cheap credit will allow people to build right through the level of demand because there will be latecomers to the party who want to buy because prices keep going up. Sound familiar? In many coastal markets existing properties are selling above replacement cost which is the Line of Doom in the apartment building investment cycle. Not to say they won’t go higher but I am definitely in ‘Show Me The Numbers’ mode.

Practically speaking that means we’re digging up markets where job prospects are good and there is solid demand for apartments while being a location with higher barriers to entry. Send us a message to discuss the markets we’ve identified as good acquisition targets.

Wow, I expected to see Houston and San Fran as top growth cities, but never expected Raleigh to have that kind of growth. Very interesting!

Very interesting about Raleigh, it looks like their job growth has turned negative too: http://www.deptofnumbers.com/employment/north-carolina/raleigh/

San Francisco is such a high barrier market that I’m surprised to see it number two on the list also.