Was quoted in a Multifamily Executive piece this week by Joe Bousquin Cap Rate Limbo: How Low Can They Go? discussing where we are in the apartment building investment cycle, whether multifamily cap rates could go any lower and how do you make a deal pencil in this environment. It’s a good quick read with apartment pros from around the country sharing their thoughts on how things stand. I really got a kick out of the Barbara Gaffen’s story about a Chicago property trading for $651,000 a unit.

Here are the rest of my comments:

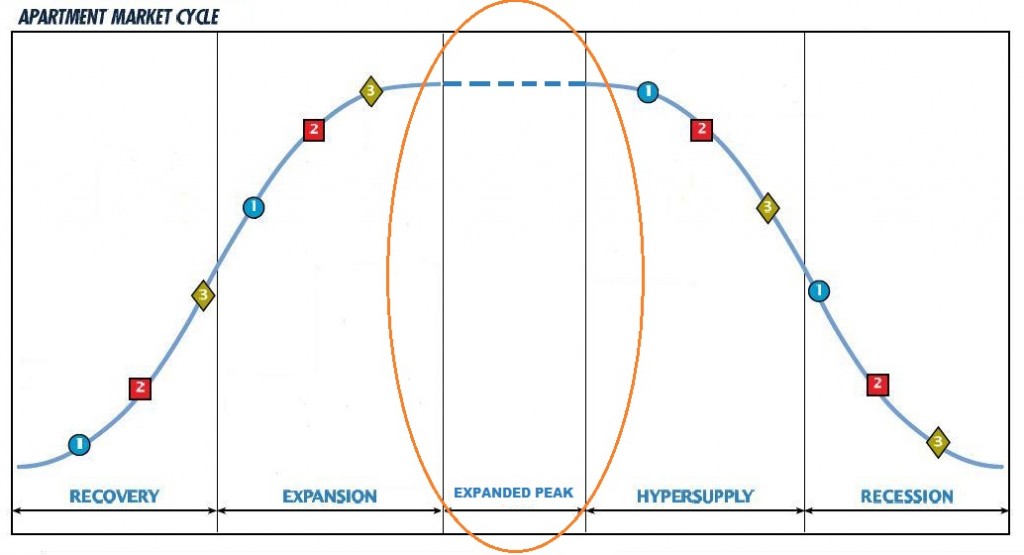

The market cycle peak is here, it’s just not evenly distributed. Cycle tops (in the absence of a financial meltdown) tend to be rounded and therefore very hard to call. We’re focused on markets in the Western US and in most of them existing sales are above replacement cost meaning that at the earliest, they’re midway through the expansion phase. As a value investor by nature I tend to think of replacement cost as the beginning of the peak but the expansion phase can carry on for quite a bit and it’s likely to do so this time. The exception would be in markets heavily dependent on oil.

There are three big types of demand that I see which will extend the peak; demand for apartments from tenants, demand from investors and deal demand. Deal demand is generated by brokers and lenders who are paid based on transactions and therefore are trying to generate as many as possible. Brokers are a constant but lenders seem to be getting on the train now too.

Demand for investments is coming from overseas investors as well as yield hungry domestic investors. With currency wars now taking place the rising dollar combined with the slowing economies in China, Europe and ROW (Rest Of the World) are making multifamily investments here more and more attractive to those looking to move wealth to a stable, more secure market. Many of these investors aren’t looking to ‘make’ money as much as not lose it. Domestic investors particularly retirement money looking for yield or returns of any kind are in a tough spot.

How much new money do you want to put to work in the stock market at these valuations, six years into the bull market? On the fixed income side they’re getting a pittance and I believe the Fed is trapped and we are turning Japanese*. With economies outside the US slowing, exports getting more expensive in their destination currencies and ever cheaper (in exchange rate) outsourcing costs it’s hard to see how we’re going to generate much wage growth and/or inflation that would spur the Fed to raise rates materially. Based on that I believe the cap rate spreads can hold much longer than anyone expects. Remember that everyone has ‘known’ that rates are going up every year for three years now and I don’t think the fundamentals have changed that much.

The third piece of demand is from tenants themselves and research we’re working on right now suggests that actual apartment demand over the next few years at least is north of 500k per year. The perfect storm of demographics, underemployment, Recession Babies and lifestyle changes are creating demand where the jobs are; tech, meds, eds and until last summer, in the oil patch. Seattle is my home market and over the last few years every time someone would announce another big apartment tower going up I would think who’s going to rent all those units on top of what’s already been delivered, sure enough Amazon (or Google, Facebook, even Elon Musk) would announce they were leasing, buying or building office space for another 1,000 employees. In the west; Austin, the Bay Area and Denver are riding the same wave along with smaller markets like Portland and Salt Lake City. Similar to Burger King’s strategy of putting a store across the street from every McDonalds, apartment market selection can be made by going where Google has an office.

Can cap rates go lower? Yes. Hard to believe but true. Vancouver BC has cap rates in the low 3s based on brokers’ proformas which means they’re really in the high twos, especially as a buyer’s cap which I’ve seen down into the low 2s even.

With all that as background what are we looking at? My private equity and syndication clients are in a tough spot because their investors want to go for another round but the low hanging fruit has been picked and the two choices in this part of the cycle really are build new or invest for at least a cycle and a half. Most LP investors get itchy after about five years so that leaves building or really deep rehabs which are often tougher than building new from a construction risk standpoint. Retirement plan clients can get on board for a long term hold but finding properties that will yield anything fully reserved is really tough.

For me personally I think new is the best choice right now, in fact I was meeting with a developer about joint venture deals this morning. Build to a seven cap and refi or sell at a five once you’re stabilized. Because I’m such a small player I can go places larger outfits won’t so I think that’s my edge. Smaller markets are typically riskier but I believe there are some that benefit from the same demand patterns as larger markets where the risk is reduced.

UPDATE: In conversations I’ve been asked to explain my ‘turning Japanese’ comment above so it bears adding here. Japan’s lost decade or Ushinawareta Nijūnen began after the collapse of their real estate and stock market bubbles in 1989/1990 which means it’s old enough to be graduating with a masters degree this year. Unfortunately for us our government and the Fed are following the exact same game plan of protecting the banks and helping them to hide their insolvency at the expense of the economy, especially down at the Main St. level. That’s why I believe this apartment cycle will have an extended peak similar to the illustration above or How I Learned to Stop Worrying and Love The Bomb Low Cap Rates. If you want to have déjà vu all over again read the Wikipedia page Lost Decade (Japan). For a deeper look see the NBER report: The Causes of Japan’s “Lost Decade”: The Role of Household Consumption. And then there was that Vapor’s song from the ’80s.

Would love to hear your thoughts and comments too- good hunting.

It’s crazy how many units have been built. Foreign buyers are flocking in still gobbling things up though. I am working with some Chinese buyers who want to build condo’s on the east-side. Their scope of comprehension isn’t really beyond Seattle or Bellevue though. They are chasing “safe” assets in areas they know. They don’t really care about the price or cash-flow, it’s just odd. Must be some stuff going on in China I can’t really comprehend. Interesting times indeed! – Zach Schwarzmiller, Advisor with Coast/SVN in Seattle

I would echo everything you say. Rent and occupancy fundamentals remain good and will for another 2-3 years as supply (though increasing) will lag renter demand. That said, sales are above replacement costs in many (especially large metro coastal markets) places, and that cannot last forever. But capital flows will get much higher, pushing prices up even if interest rates rise. – Peter Linneman, NAI Global Chief Economists and Emeritus Professor of Real Estate at Wharton