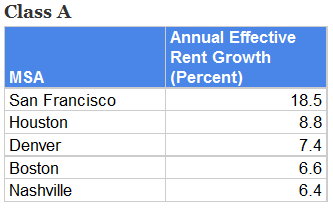

In an update to our earlier update on top markets, Axiometrics has put out a report on the top 5 apartment building investment markets for rent growth by asset class.

San Francisco is rocking in class A and B, and in class C it’s….. San Francisco! Interestingly A and C properties there are showing rent growth of almost twenty percent while class B is just under ten percent. Any thoughts on why A and C are double the class B rent growth in SF? Note that 9.3% in class B still leads the US- Continue reading Top 5 Apartmentment Building Investment Markets for Rent Growth, by Asset Class.