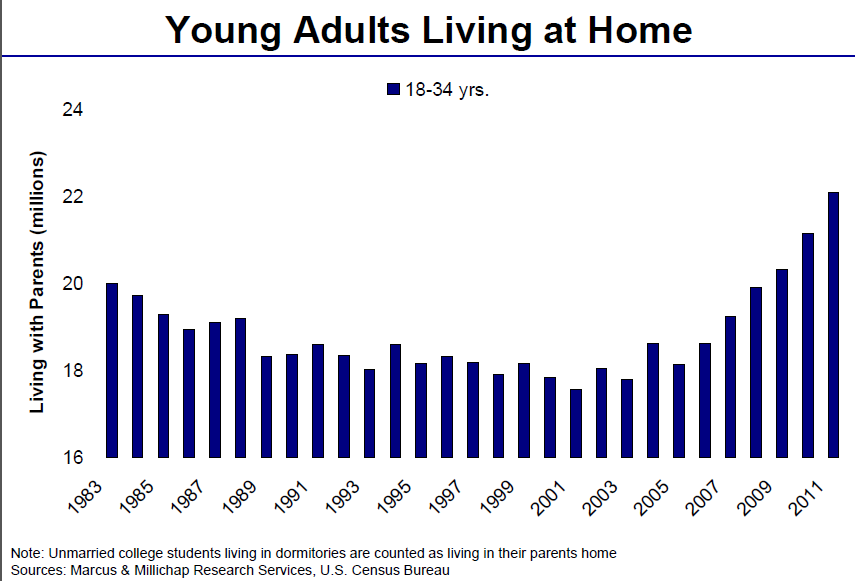

In yesterday’s MFE article What Does the Fed News Mean to Apartment Owners?: “the median net worth of middle class families plunged by 39 percent in just three years.

The Fed used a hypothetical family with $126,400 in 2007 to prove that point. In 2010, that same family’s net worth dropped to $77,300. Median family income also fell—from $49,600 in 2007 to $45,800 in 2010. The number comes from the Fed’s Survey of Consumer Finances, due out this coming Monday.”

Then in a WSJ article Why Housing Affordability Is a Mirage: “Home prices and mortgage rates have made monthly mortgage payments lower than at any time in the past decade. But housing isn’t any more affordable than it was five years ago… the total cost of homeownership, as a share of a borrower’s income Continue reading Net Worth Falling + 20% Down Payment = 1 Million Renters Added in 2011 #Multifamily