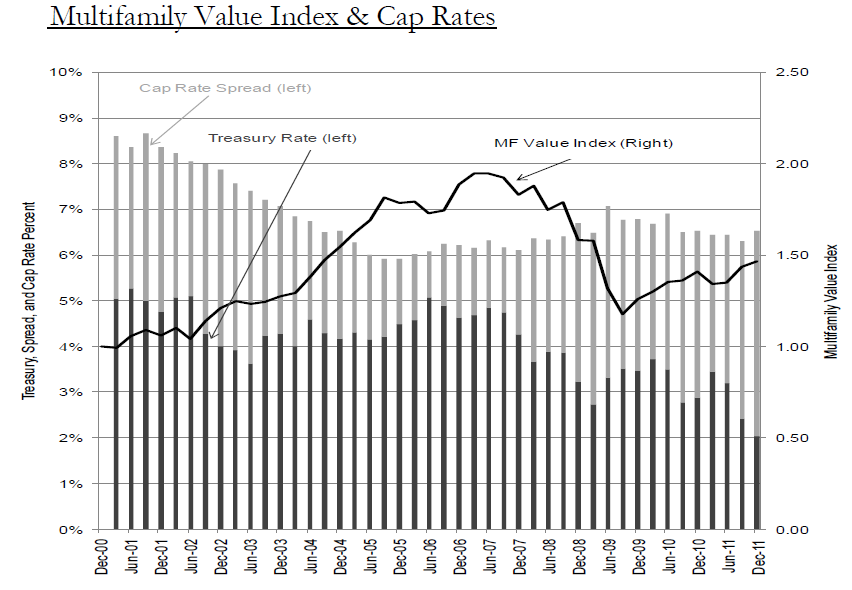

A very interesting report on apartment building investment posted on the Freddie Mac website discussing Current Multifamily Values & Cap Rates In Historical Context explores where the market is today and where it is likely to be in five years under a number of different interest rate scenarios. Freddie doesn’t do loans smaller than $5 million (implying a minimum deal size of $6.6-7 million) and many of their borrowers are large institutional investors but the forecasting methods and valuation models they use are applicable to apartment building investing on any scale.

Some takeaways from the report:

Rental growth rates are expected to be Continue reading Freddie Mac sees strong apartment rental growth next five years in valuation report.