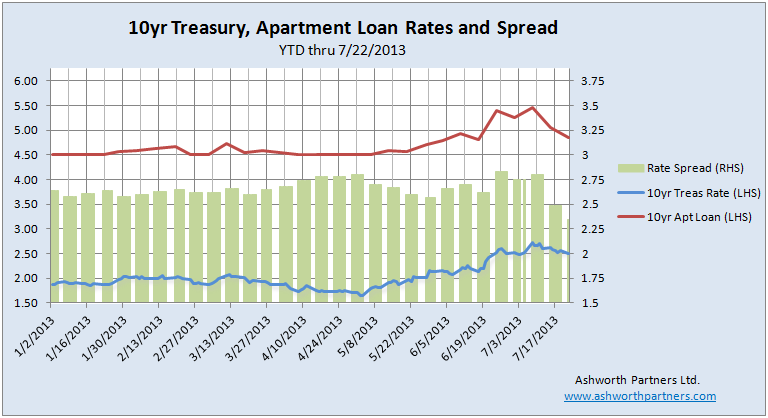

Back on June 24th I wrote a post Analysis on Tapering QE3 talking about how traders fears about the end of the Fed’s money printing spree made the interest rate on the 10 year Treasury jump. And as I mentioned in a follow up post Update on the 10yr Treasury rate we care about the 10yr Treasury (or T10) because it’s the benchmark most lenders base long term loan rates on. But there is one more component of apartment loan rates (and lending rates in general) that I want to draw your attention to. First an updated chart:

I’ve updated the chart with the latest rates and also added the rate for an apartment loan with a fixed rate for 10 years from one of our lenders (details on the loan terms below). The other thing I added was the spread, or difference, between the two rates (on the Right Hand Scale). So far in 2013 the spread has averaged 2.65% or 265 basis points (bp) but it’s not a fixed amount that the lender adds to the T10. You can see that back in the beginning of May when the Treasury rate got as low as 1.66% the spread widened to 280bp because the loan rate was left at 4.5%. Then the spread narrowed back towards the average even while interest rates went up from there.

Then the Fed meeting notes came out in the middle of June and the T10 shot up but we got a double dose because the spread jumped up too. The Treasury went from 2.19% on the 17th to 2.57% on the 24th, and the spread jumped from 262pb to 283. It makes sense that in the uncertainty of a sudden rise in rates that lenders would widen their spreads to create a little breathing room but since then things have gotten quite interesting… in a good way. The good news is that since then the spread has Continue reading Apartment Building Loan Rates Fall as Spreads Narrow