Report on the state of apartment building investment markets from the good folks at Joseph Bernard Investment Real Estate in Portland:

Continued positive multifamily demand fundamentals and ready access to capital at attractive rates is fueling a surge in new apartment development, according to industry executives.

Continued positive multifamily demand fundamentals and ready access to capital at attractive rates is fueling a surge in new apartment development, according to industry executives.

Several hundred senior-level apartment executives gathered in Scottsdale, AZ, last week for National Multi Housing Council’s (NMHC) Apartment Strategies/Finance Conference and Spring Board of Directors Meeting. The following is the NMHC’s summary of what was discussed.

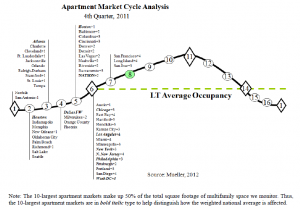

Continued low levels of new supply have led to a big bounce-back in rents as demand outpaces new construction. According to one panel of apartment executives, the new supply shortfall may be larger than once thought — as many as 700,000 to 1 million units — because many of the apartments built in recent years have been in the affordable, rather than market-rate, section of the market. Moreover, much of the current apartment stock dates back to the 1970s and is becoming obsolete, creating additional demand for new supply.

Select areas have seen such large upticks in the number of planned and under construction units that could turn into hot spots for potential overbuilding. In particular, certain submarkets of Phoenix, Seattle and Washington, D.C., appear somewhat at risk.

But, overall, new completions are still a very low percentage of total inventory.

Money Flowing for Multifamily

There is a wall of private capital that wants into the multifamily space. More than 250 private equity funds currently are Continue reading Phoenix, Seattle and Washington, DC apartment markets at risk of overbuilding says NMHC panel