Home prices have crashed. Interest rates are at all-time lows. If you’re in the market to buy, homes are more affordable than they’ve been in years. Or are they?

From a WSJ report posted by Motley Fool:

The median down payment in nine major U.S. cities rose to 22% last year on properties purchased through conventional mortgages. … That percentage doubled in three years and represents the highest median down payment since the data were first tracked in 1997.

Up 22%! yowza! More from MF:

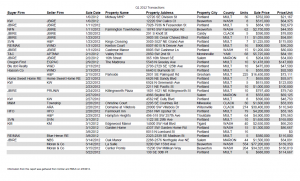

The average home in America now sells for $272,000, so a 20% down payment totals about $55,000. The median household net worth, meanwhile, was $67,000 in 2010, suggesting the average homeowner needs to tie up a tremendous amount of their net worth in a down payment. Can you really Continue reading The secret about home ‘affordability’ they don’t want you to know- Good for Apartment Building Investment