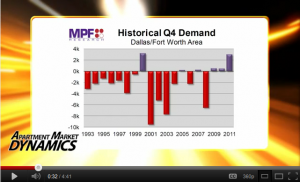

Year-over-year rent growth reached a two-decade high in the Dallas/Fort Worth apartment market. And demand in 4th quarter — typically a slow leasing period — was unusually strong.Record Multifamily Rent Growth in DFW

Leading Indicators and the Risk of a Blindside Recession. In-depth on economic indicators from John Hussman

Over the past few weeks, investors used to setting their economic expectations based on a “stream of anecdotes” approach have seen their economic views evolve roughly as follows:

“After a brief ‘scare’ during the third quarter, economic reports have come in better than expectations for weeks – a sign that the economy is on a gradual but predictable growth path; Purchasing managers reports out of China and Europe have firmed, and the U.S. Purchasing Managers Indices have advanced, albeit in the low 50’s, but confirming a favorable positive trend, and indicating that the U.S. is strong enough to pull the global economy back to a growth path, or at least sidestep any downturn…”

“Unfortunately, in all of these cases, the inference being drawn from these data points is not supported by the data set of economic evidence that is presently available, which is instead historically associated with a much more difficult outcome. Specifically, the data set continues to imply a nearly immediate global economic downturn… Frankly, I’ll be surprised if the U.S. gets through the first quarter without a downturn.” (Underlining mine)

Definitely worth a careful read: http://bit.ly/ArTDyK John Hussman is a value investor and a serious student of the economy, we may not always agree with him but we should not dismiss his research.

Apartment Building Investments still attractive for 2012 says Gary Shilling.

Gary likes small luxuries, health care and apartments among investment sectors.

On Apartments: “last year our index of apartment REITs gained 14%. This year we look for further gains in rental apartment prices and securities related to them. Rental apartments will continue to benefit from the separation that Americans are beginning to make between their abodes and their investments. The two used to be combined in owner-occupied houses back when owners believed house prices never fall, and they hadn’t since the 1930s. So they bought the biggest homes they could finance. The collapse in house prices has shown them otherwise. A further 20% weakness in the prices of single-family houses due to the depressing effects of excess inventories will add fat to the fire.

It will take a surprisingly small shift in housing patterns to make a big difference in the demand for and construction of rental apartments. Today, there are 114 million housing units in the U.S., of which 38 million are rented. If only one percent of total households decided to move to rented units, the demand for rentals would increase by over one million, most of which would need to be newly built apartments, after current vacancies are absorbed. This is a big number compared to new apartment starts of 333,000 on average over the past 10 years. To put it another way, each 1% decline in the homeownership rate increases rentals by more than one million, to the extent those ex-homeowners don’t double up.

Rental apartments will also appeal to the growing number of postwar babies as they retire, downsize and want less responsibility and more leisure time.

See all of Gary’s picks in this edition of John Mauldin’s Outside The Box

Multifamily’s Future in 2012

Amid limited supply and demand edging up, market conditions for the multifamily sector should be favorable in 2012 but Europe is a wildcard for the economy. Demographics support demand says Ron Witten, president of Witten Advisors; “The data suggests that somewhere over 60 percent of the jobs created in 2010 and 2011 have been 20- to 34-year-olds going to work. That’s very good news for the apartment sector.” See more at: http://bit.ly/Aq73Sf

Fannie, Freddie expected to remain dominant Multifamily lenders over next 2-5 years. Video

… and other apartment market predictions for 2012 from industry leaders. See video here: Fannie, Freddie to remain dominant Multifamily lenders next 2-5 years

Feds to turn foreclosures into rentals, Good for Multifamily?

(CNNMoney) — Federal officials hope to launch a pilot program in early 2012 to convert government-owned foreclosures into rental properties.

The program, which was cited by Federal Reserve Chairman Ben Bernanke last week as one way to address the housing crisis, would sell foreclosed homes now owned by Fannie Mae and Freddie Mac to investors in bulk. The properties would then be converted into rentals.

“… every MERS mortgage is defective” a NY State Supreme Court judge.

If you have taken out a mortgage on (or refinanced) your home (or business property) in the last 10 years or so chances are the title of your property is clouded so badly that no one can legally foreclose on your loan. This is the result of an illegal, little known operation that was specifically setup to expedite the rapid securitization and trading of mortgage securities. Further it was explicitly devised to circumvent the centuries old democratic process of recording property ownership and mortgages against those properties at county clerks offices across the country.

See the quotes below, read Barry Ritholtz’ take on it here: http://bit.ly/yGMaGc or read the whole article here: http://harpers.org/archive/2012/01/0083752 Not a subscriber? $15.00/year through Amazon: http://amzn.to/zQDafi Continue reading “… every MERS mortgage is defective” a NY State Supreme Court judge.

US Multifamily for 2012: Rents up 4-1/2%; occupancy +50bp; more room in B props for rent growth. Video

More of the same is the general outlook but opportunities exist in Class B and specific markets. See the video here: http://bit.ly/Avv9aj

Portland OR Multifamily vacancy +/-3% but expenses rising

Unemployment still 9% and tenants in C props having harder time keeping up with expenses and rising rents. Meanwhile developers will need three years of building to bring market back into balance. See more at: http://bit.ly/wxm5jf

Only 38k Multifamily units added in 2011; demand = 300k+. Grubb & Ellis 2012 Forecast

New development is picking up but is restrained by lack of lender appetite.

Senior housing to see vacancy decline below 10% also.

Via Grubb & Ellis’ 2012 Real Estate Forecast available here: http://bit.ly/xfBnmd

Thanks to Jason Brumm of G&E San Antonio