Tom Barrack over at Colony Capital put up a nice presentation of where he sees the opportunities for real estate investment in the current market. While Colony is geared to serving their large institutional investors, those of us operating on a smaller scale can benefit from Tom’s insights as well.

My Exec Sum of the opportunities he sees that I think will impact smaller investors in North America (and my comments in parentheses):

- Commercial and residential real estate are great investments today because equities and debt are mispriced and the economy is regaining its feet. (There will be competition however).

- Distressed debt in the US is diminishing but they are continuing to resolve non-performing assets (which can create deals for long term holders as these turned around assets come back to the market).

- Single family residential for rent housing is stabilizing and becoming a institutional asset class (which can provide exits for those who have built portfolios of these properties).

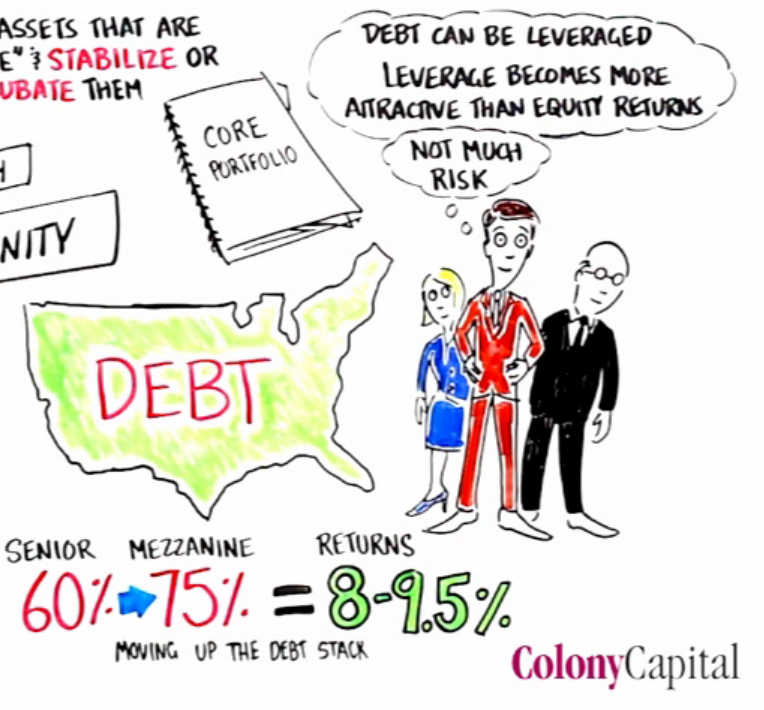

- Mezzanine debt and what he calls ‘stretched senior debt’ is becoming more available for value add & opportunistic deals because institutional investors such as pension funds need the extra yield (it will be easier to finance turnaround commercial properties at higher LTVs).

- It’s a time to avoid taking on floating rate debt because he thinks interest rates will have to rise (they will inevitably but could be delayed for an extended period of time because the Fed is battling deflation and we could be turning Japanese).

- Now is the time to manufacture core properties by repositioning existing but obsolete buildings (We will be facing more institutional competition in smaller markets and smaller properties than before so we must invest with the idea that cap rates will continue to remain compressed as the big outfits come into markets we once had to ourselves).

Click on the image above to see Tom’s presentation. He’s one of the smartest real estate guys around and he’s been a virtual mentor of mine since he started buying distressed properties from the RTC back in the 1990s.

Just as Tom says, pensions are upping their allocations to real estate: “Texas Teachers could boost RE by $3bn

The $126.12 billion pension system has presented a strategic asset allocation plan that will increase its target real assets allocation by 3 percent, bumping up its real estate target by approximately $3 billion.”

https://www.perenews.com/Templates/PageBuilderPages/FullWidth.aspx?pageid=3073&LangType=2057&pei_section=4&news=12885377112#

Note: Free registration at PERE may be required to view the article.